|

Have you ever attended a networking event with people from different industries who all introduce themselves in industry jargon? “I’m a PMP at EMC in charge of implementing ERP.” That’s usually my cue to head off in another direction. The investment industry is no different – we may even be the worst offenders. When Alpha Capital Management performs investment consultant searches or OCIO searches for our clients, we generally interact with finance staff and Investment Committee members. Even in these circles, we’re not speaking exclusively to investment professionals. Studies show that 70% of the members on a typical volunteer non-profit Investment Committee have investment experience – so on average, at least 1-2 people in the room with us are not investment experts. We try our best not to use a lot of industry lingo, but it can be hard! Here’s a great example: "OCIO." This is an acronym we use constantly – in fact, it is at the heart of many of our client engagements. The first decision that an Investment Committee often needs to make is whether to “go OCIO” – that is, whether to outsource to a third party any of the investment decision-making functions that currently rest with the Committee. But before a Committee can make that decision, each of the members need to know what we mean when we use the acronym OCIO. With that in mind, school is now in session. Welcome to OCIO 101. First Lesson: What does OCIO mean? “OCIO” is an acronym for Outsourced Chief Investment Officer. Many large organizations, especially in the non-profit world, have Chief Investment Officers (often shorted to “CIOs”) who oversee their investment assets. A well-known example is David Swensen, the legendary Chief Investment Officer of Yale University’s $30B Endowment from 1985 to 2021. Organizations can also choose to outsource this job to an external firm, hence, an outsourced CIO or OCIO. To understand what an OCIO does, it helps to first understand two things:

What does a Chief Investment Officer do?A Chief Investment Officer is ultimately tasked with earning appropriate returns on an organization's investment portfolio. A CIO's typical job responsibilities are a mix of portfolio management, people management, and investment operations. A CIO might:

But not every institution is as big as Yale and can dedicate a salaried position (let alone several) to investments. Many institutions (especially those with less than $500M in assets) do not have a dedicated Chief Investment Officer and find ways to split up these duties across other staff members (the Chief Financial Officer is a common choice) and volunteer Investment Committee or Board members. Often, the Investment Committee hires one or more prudent experts to assist. That's where an investment consultant comes in. What does an Investment Consultant do?The most common governance structure for institutional investors, for a long time, looked like this: Key: Investment Committee makes portfolio decisions with advice from external Investment Consultant. Decisions are executed by the Chief Financial Officer or other internal staff, often in the finance department. Not shown is the Board of Directors, who may delegate responsibilities to the Investment Committee or review and approve recommendations from the Investment Committee. Under this arrangement, everything rests on the shoulders of the volunteer Investment Committee. As we learned earlier, most Investment Committees are not comprised entirely of investment experts, nor do they have the time and resources to perform investment due diligence. Committees need expert advice and analytical firepower to help them make the big decisions they are tasked with – namely, how to prudently invest the assets under their care so that those assets can meet the organization’s needs, and hopefully also grow over time. The role that the Investment Consultant plays as a prudent expert hired by the Investment Committee is to provide advice, do the heavy lifting on asset allocation studies and investment manager due diligence, and to help the Committee properly discharge its fiduciary duty. Under this governance model, the Investment Committee makes portfolio decisions based on the advice of the Investment Consultant, and the Chief Financial Officer or other staff implement those decisions by performing tasks such as signing documents and moving assets. We simplify the governance structure here by not showing the Board of Directors. Some Boards choose to delegate investment responsibilities to the Investment Committee, while others may choose to retain investment decision-making authority at the Board level while utilizing the Committee as a recommending body. In either case, the governance structure above still applies. Second Lesson: What does an OCIO do? The traditional investment consulting governance structure we described above still exists, but this structure can place a heavy burden on an Investment Committee. An institution could expect to earn an annualized 7.5% return in 1989 just by investing in bonds and cash, according to a 2019 white paper by Callan Associates. By 2019, to earn the same expected return required a diversified portfolio with stocks, real estate, and even private equity. It becomes harder and harder for Investment Committees to properly oversee portfolios as those portfolios grow in complexity. It is no surprise, therefore, that the OCIO model has taken off like a rocket in the past ten (really the past five) years. This model shifts some of the Investment Committee responsibilities and some of the Chief Financial Officer responsibilities onto a new player, the OCIO, who expands upon the original role of the Investment Consultant. Like this: Key: Investment Committee oversees portfolio strategy with advice and input from external OCIO. Many day-to-day decisions are made by and executed by the OCIO. The CFO or internal staff have a supporting role. Our previous note about governance structures that include the Board of Directors still applies. Under this model, the Investment Committee retains control over the most important portfolio strategy decisions. These decisions include risk tolerance, return objectives, and strategic asset allocation, all of which are codified in the Investment Policy Statement ("IPS"). The OCIO is empowered to make day-to-day decisions such as tactical asset allocation and manager selection within the framework of that IPS. The OCIO also implements those decisions by signing documents and moving assets. The CFO and staff have a supporting role. Third Lesson: What Kinds of Firms Act as OCIOs? Based on what you've learned so far in this course, you may have already guessed that two of most popular types of OCIOs are:

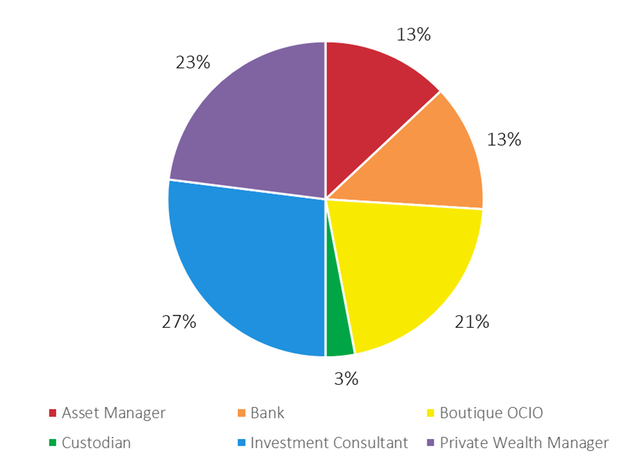

These two groups aren’t the only ones with the right skill set to offer OCIO solutions to institutions, of course. In fact, there are over 100 firms today who offer OCIO services, according to executive search firm Charles Skorina. We sorted Skorina’s list by the primary business line of each of these firms (refer to the pie chart below), which provides an interesting look at the mix of firms competing for OCIO business. We should note that the pie chart is not weighted by OCIO assets under management, which would meaningfully change the analysis. For example, half of the 10 largest global OCIOs by 2021 assets under management either currently serve as investment consultants or morphed from investment consultants into pure OCIOs, although such firms make up about a quarter of the overall universe of OCIO providers. There are also no boutique OCIOs represented in the top 10 list, which makes sense given capacity constraints inherent to the boutique service model. Other firms who have leveraged existing skill-sets and business lines to provide OCIO services include asset managers (particularly those with multi-strategy investment products), banks and trust departments, private wealth managers, and custodians. It is important for Investment Committees to understand the strengths and considerations that go along with the firm offering OCIO services. For example: firms may offer additional value-add services beyond investments that an organization finds helpful, such as lending or custody. However, conflicts of interest may arise if OCIO firms offer more than one service that should be disclosed, mitigated, and fully understood. We recommend that Investment Committees consider more than one type of OCIO firm in a search. It helps to compare and contrast. Are All OCIO Models the Same? No! Let us repeat, NO! Just as OCIOs evolved from a variety of different firms, there are a wide number of potential OCIO models to choose from. Alpha Capital groups OCIO models into three main categories:

Final Exam Want to share this piece? Download a sharable version here.

Comments are closed.

|

Author

Anna Tabke, CFA, CAIA Interest

All

Archives

April 2022

|

Copyright © Alpha Capital Management