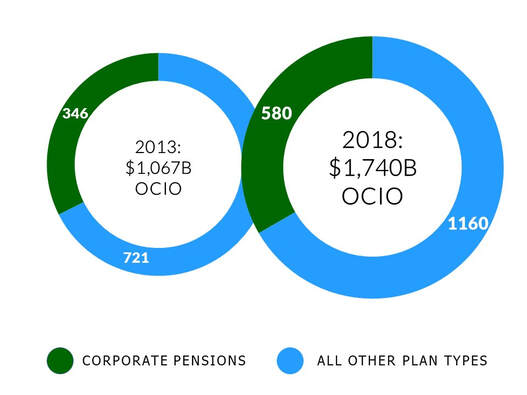

Virtually unheard of a decade ago, the outsourced Chief Investment Officer (“OCIO”) marketplace has exploded. OCIO providers had more than $1.7 trillion in fully discretionary or partial discretionary assets under management (“AUM”) in early 2018, on a projected base of over $6 trillion total “outsourceable assets.” OCIO assets in the US have grown significantly over the past decade, and OCIO assets under management are expected to continue to grow at low double-digit rates for the foreseeable future, according to projections from Cerulli Associates and Pensions & Investments. In fact, Cerulli projects that US OCIO assets will increase by $671 billion over the next five years alone. With such attractive growth prospects, it is no surprise that all sorts of firms are entering the market to offer institutional OCIO solutions. Alpha Capital Management tracks nearly 100 different firms offering OCIO services. Many of the OCIOs who have been most successful in attracting clients are consultants. In this blog post, Alpha Capital Management offers our thoughts on the three primary reasons investment consultants are embracing OCIO. Our next blog post will cover three challenges that consultants-turned-OCIOs face. Reason #1: Clients Want It OCIO is growing because clients demand it. Why now? Let’s look at a few real-life examples from Alpha Capital Management’s search clients. A $200M frozen pension plan finally saw their funded status top 90%. The CFO was thrilled. But by the time they went to lock it in, the markets moved against them. When we were called in to do a search, the funded status was back in the mid-80s. This number was so important to the CFO that he asked finalists if it could be pushed to him daily via text message. They went OCIO. Pensions like our search client are a huge part of the OCIO market. This was true five years ago, and it is still true today. As Pensions & Investments reported in June 2018: “Large managers of discretionary OCIO assets said one of their biggest sources of new business in the past year and expected to be going forward is from corporations contemplating the fate of their defined benefit plans.” Defined benefit plans have kept pace with the massive growth of OCIO and still represent a third of the global OCIO marketplace, as shown below:

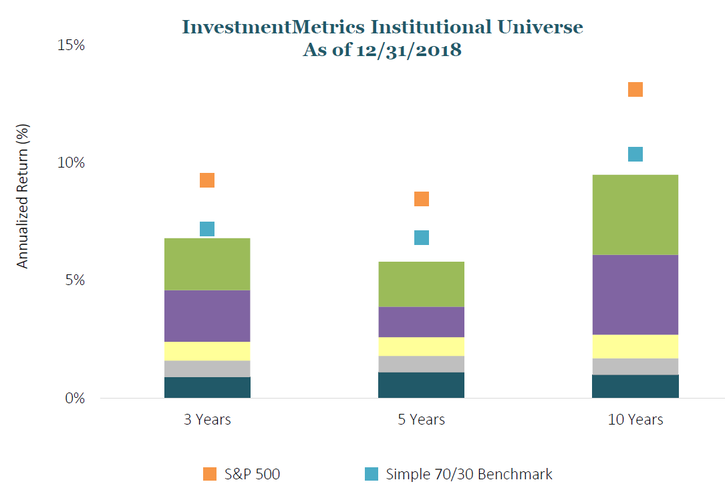

Here’s another example. We worked with a non-profit with about $500M in assets. Their returns weren’t awful, but they were below their peer group median and trailing public market benchmarks over the past 3, 5, and 10 years. “We must be terrible at managing money,” thought the board. They went OCIO. It has been a tough market cycle for diversified investors like our non-profit client. The S&P 500 has beaten InvestmentMetric’s entire institutional universe, as shown here: Of course, we are not arguing that the S&P 500 Index is a fair comparison, or even a reasonable one, for a diversified portfolio. But it is undeniably a visible, well understood, and highly discussed benchmark. Even against the simple blended index shown above, institutional portfolios have not kept up with the US market. Broad index returns may not mean as much as meeting client-specific goals and objectives, but these comparisons still matter to clients. We believe that OCIO has benefited from two massive tailwinds: pension plan sponsors who seek an improved governance model, and clients struggling with underperformance issues who seek stronger returns. Reason #2: Increased Revenue Potential The marketing pitch we hear for OCIO goes like this: “it leads to stronger governance and an improved decision-making process, and it allows investment committees to focus on strategic decisions rather than getting bogged down in the details of running a complex portfolio. The service model bears an increased cost to compensate for the additional fiduciary liability of the OCIO.” Consultants may not charge enough for advisory work (although our clients disagree). Try going to your advisory clients and asking for a 100% fee increase – you’re more likely to get fired than to get a client to agree. OCIO, though, has given consultants the opportunity to reset the market perception of value. An institution may be willing to pay twice as much for OCIO. This is an important factor in the explosion of OCIO offerings by consultants. Reason #3: Scalability OCIO also offers an attractive opportunity for consultants to grow more quickly using scalable solutions. Traditional investment consulting services are hard to scale. Portfolio management can be simpler and more scalable under an OCIO model. Instead of a consultant with 10 clients performing 10 individual asset allocation projects and 10 manager searches with 3 candidates per search, an OCIO does one asset allocation project and hires one manager per slot and then pushes it out to all 10 clients. It can be an attractive model from a business management perspective while offering clients a strong investment solution (and it ties back into the second point, as scalable solutions allow for higher client loads and therefore more revenue). No Wonder Consultants are Embracing OCIOThe relationship between a client and an investment consultant is a long-lasting one, and clients place a great deal of trust in their consultants. It is no wonder that clients are approaching their investment consultant as they try to navigate increasingly complex governance considerations in a challenging market environment. Consultants are well placed to offer OCIO solutions to these clients seeking more help, and indeed, we see that they are successfully doing so.

Still, we believe consultants are finding OCIO to be a two-edged sword. With the benefits of higher fees and a more scalable service model come several key challenges. In our next blog post, we will focus on three main ones: performance, operations, and conflicts of interest. This blog post is adapted from our research report, "Clients Give Consultants a Green Light for OCIO." |

Author

Anna Tabke, CFA, CAIA Interest

All

Archives

April 2022

|

Copyright © Alpha Capital Management