Investing for Good - Why is it So Hard?Investing for good. Those three words summarize an incredible diversity of investment approaches and asset classes. Everything from fossil fuel divestment to impact investing to religious screening to green bonds fall into this camp. Although there are plenty of investment styles that attempt to “invest for good,” ESG seems to be getting most of the assets (or at least, most of the press). Environmental, Social, and Governance – these are the ingredients of ESG. We’ll use so-called “ESG” investing as our example of investing for good throughout this paper as we grapple with some of its most thorny problems. Both institutions and Main Street investors are expressing a desire to make an impact with investments, and Main Street investors are directly applying pressure to institutions across the country to make big changes with their big dollars. Sustainable investments have now reached $4 trillion, according to Larry Fink of BlackRock’s latest annual letter to CEOs. Investing for good can’t be ignored. Unfortunately, it’s also a lot harder than it sounds to execute successfully. Working with both Main Street investors and institutions, we’ve seen a number of common misunderstandings pop up when investors try to understand, evaluate, and implement “do good” investing. Today, we’ll take a closer look at some of those misunderstandings and bring to light the most pressing issues that come up when our clients try to tackle do-good investing. The three thorny problems we address in this paper are:

Thorny Problem #1: The Big Tent  The easiest way for an investor of any size to get started with ESG is to buy one of the many passive index funds available today. These funds are cheap, easy, and accessible. But do they offer what investors want? I wonder if anyone has studied the proportion of ESG investors who care about all three letters: E (Environmental), S (Social) and G (Governance). Even within each of the three pillars of ESG, these are big groups that try to tie together the values of many disparate individuals. Let’s dig into S(ocial) as an example. If you think about the early days of ESG investing, the original S(ocial) investment fund often followed religious principles. In many ways, the original S is a relatively easy problem to solve as a fund company since the religion itself has a stated, defined belief system that large populations of individuals follow. Prominent religious figures provide guidance to the fund company in accordance with that belief system, and a fund is born. The market has exploded today, and values systems that fall under S(ocial) have multiplied. For some investors, S is still screening based on religious principles. For others, it’s about Societal benefit – including rewarding companies with forward-thinking employee benefits like family leave. For still others, it can be gender equality or diversity or any other number of deeply rooted social issues. Which S is which? Multiply that by varying possible interpretations of E(nvironment) and G(overnance), and you start to see the issue. Trying to solve the Big Tent is how you end up with a fund excluding companies that:

So – raise your hand if this entire list aligns with your belief system. … Bueller? Most likely, your answer is “no.” You might want to divest from fossil fuels but have nothing against alcohol companies, for example. This is the Big Tent problem in a nutshell. ESG investing is a blunt tool, and it’s unlikely to truly reflect the value systems of most, or even many, of the investors it attracts. Institutions have an even larger problem. Why? Because an institution may have an overriding mission statement that drives its vision, but institutions are also comprised of lots and lots of individuals who bring their own ideas, biases, and visions to the table. For example, student activism on college campuses aims to drive change in school endowment portfolios. A popular aim of student activism is to seek divestment from fossil fuels. Does this align with the mission statement of a school like Harvard University? Maybe – it depends on who you ask. Divest Harvard certainly thinks so. It is especially important for institutions to be mindful of the Big Tent problem in order to effectively work through conversations around ESG and other related investment styles. Who, what, when, where, how, and why are key questions to come to consensus around before implementing an ESG-style portfolio to ensure that the investment approach truly aligns with the mission of an organization. Let’s say your organization has undergone a thoughtful, deliberate process to consider ESG. Your consensus is to start incorporating ESG into your portfolio by buying a broad-based ESG index fund. Great start! Your constituents are thrilled. Or are they? That brings us to another thorny problem which I like to call The Swoosh. Thorny Problem #2: The Swoosh  I own WHAT? Once you adopt ESG as an organization, you’d like to think that investor outrage over your investment holdings subsides. After all, you’ve gone through a process to develop an ESG approach and align the portfolio with that approach, so everyone should be happy now. Right? Not so fast. One of my most memorable ESG fund due diligence calls was when a manager told me with a straight face that [a certain producer of athletic shoes] was a major holding in that fund. You mean the one with all those 1990s sweat shops? Yes, that one. The company made the grade in this particular portfolio because they scored highly on the governance “improvement” metric. In other words, they started from a very low hurdle and managed to clear it. Welcome to the hallowed halls of ESG. Investors who want ESG in theory might not understand the compromises that building an ESG portfolio entails in practice. As we saw in the past example, ESG funds cast a wide net and own plenty of “ESG in practice but not in spirit” companies. Maybe what those constituents really meant was that they want you to own forward-looking companies investing in technologies that may save the planet — for example, electric cars or clean energy—rather than owning stocks that score highly on a confusing matrix that intersects E, S, and G without really focusing on investing to do good. Some large investors have the option of impact-oriented funds who seek out and fund such niche projects, especially within private assets, but those types of funds are not available to all. Niche public equity funds exist, but they tend to suffer from The Swoosh. Take a look at a “clean energy” mutual fund, for example, and you’re sure to see a lot of major utility companies. Why? Because those companies are funding clean energy like wind and solar as a division of the larger company, not as a standalone investment. Another example is the automotive industry, where major producers of gas guzzling vehicles like Volkswagen are also developing and building electric cars. You have to buy the past to buy the future. You don’t want to own the past? That brings us to our third and final thorny problem, The Fraction. Thorny Problem #3: The Fraction No, not that kind of fraction. This thorny problem starts with the realization that off-the-shelf ESG options don’t meet an institution or individual’s needs. “Let’s just design a custom portfolio that meets our investment objectives AND the ESG principles we’ve agreed to,” you might think. Great idea! But not so fast. Main Street investors and small institutions face the problem of fractional shares — most small portfolios simply don’t have enough dollars to invest in truly customized portfolios without buying less than one share of many stocks. If you have $10 to allocate to Apple, but a share of Apple costs $200, you must have the ability to buy less than one share (a fractional share) in order to build your portfolio. This technology is slowly making its way to the market, at least for US equities, but it is currently very limited. Fractional share investing works in concert with direct indexing to enable small portfolios to build customized ESG portfolios. Direct indexing allows an investor to start with a public index (like the S&P 500) and strip out anything that investor does not want to own. Don’t like Volkswagen? No problem, just exclude it from the index. Larger institutions have some direct indexing options available (like Aperio or Parametric), and our hope is that these options become more available to smaller investors as technology improves. Larger institutions have a separate but related fraction problem, where the portfolio itself is invested across many different asset classes. Investment dollars in any one asset class is a fraction of the whole (potentially leading these institutions to face the same fractional share problem as smaller investors), and there’s the added hurdle of whether customized ESG can reasonably be implemented in some asset classes at all. Spoiler alert— it probably can’t. US stocks are the easiest asset class in which to build customized ESG portfolios (and the larger the market capitalization of the stock, the easier it is). Logistical hurdles to implementing custom ESG portfolios multiply outside of US stocks. Data availability can be spotty in international markets, and countries may vary in their investor registration requirements. Bonds are even more complicated. Each share of Apple stock is the same, but each Apple bond issue is unique, so supply is very constrained and make individual bonds hard to purchase in small lots. There isn’t a lot of ESG-friendly bond issuance to choose from, either. And then there are alternative asset classes like private equity. Private investments have a whole host of challenges that institutions must grapple with, like access and illiquidity. Investors may not be able to access private funds that align with their values at all, or they may not be able to withdraw from a fund who later makes an investment counter to the investor’s ESG guidelines due to the illiquid nature of these investments. In each asset class, investors must consider the availability of ESG options and compromise, compromise, compromise. The Compromise There are very thorny problems with ESG, whether you have $100 or $1B to invest. Committing to ESG or other do-good investing requires compromises every step of the way. A strong understanding of what’s possible to achieve in your portfolio with the tools available to you today is critical to success for any investor. If you’re starting down this path as an institution, we can’t stress enough how important it is to educate, educate, educate, and to take the time to build consensus with your constituents around a meaningful, aligned ESG approach. Yes there are thorny problems, but this is a worthwhile endeavor to consider. With $4T invested in sustainable investments already, and more added every day, these conversations are only becoming more important. We hope that this paper has helped you start thinking of ways to overcome these challenges.

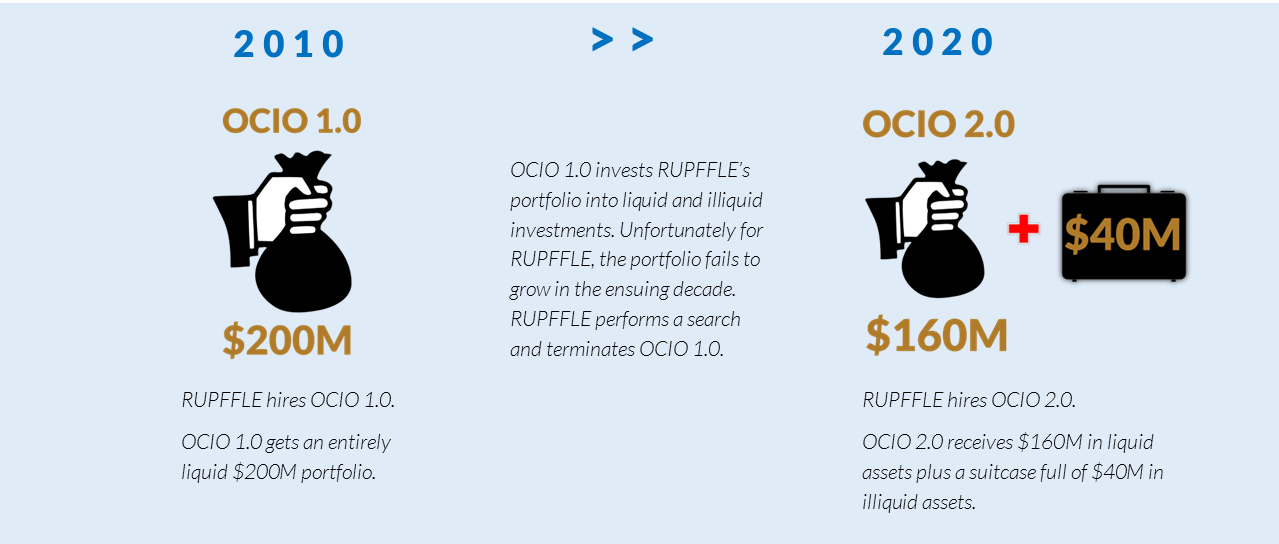

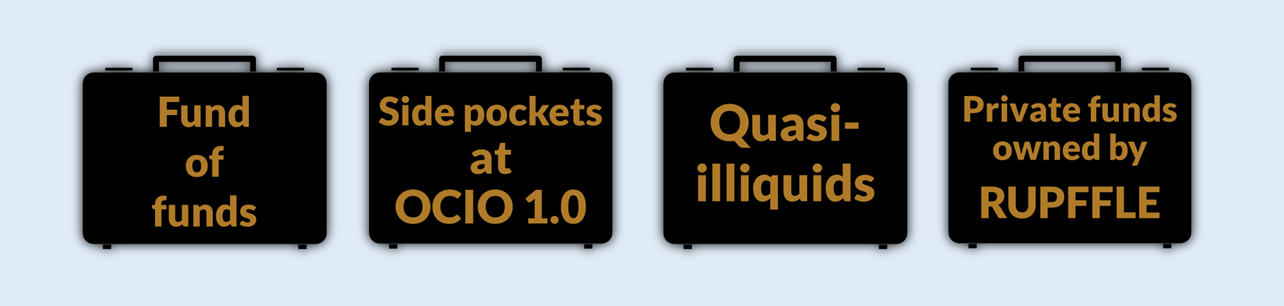

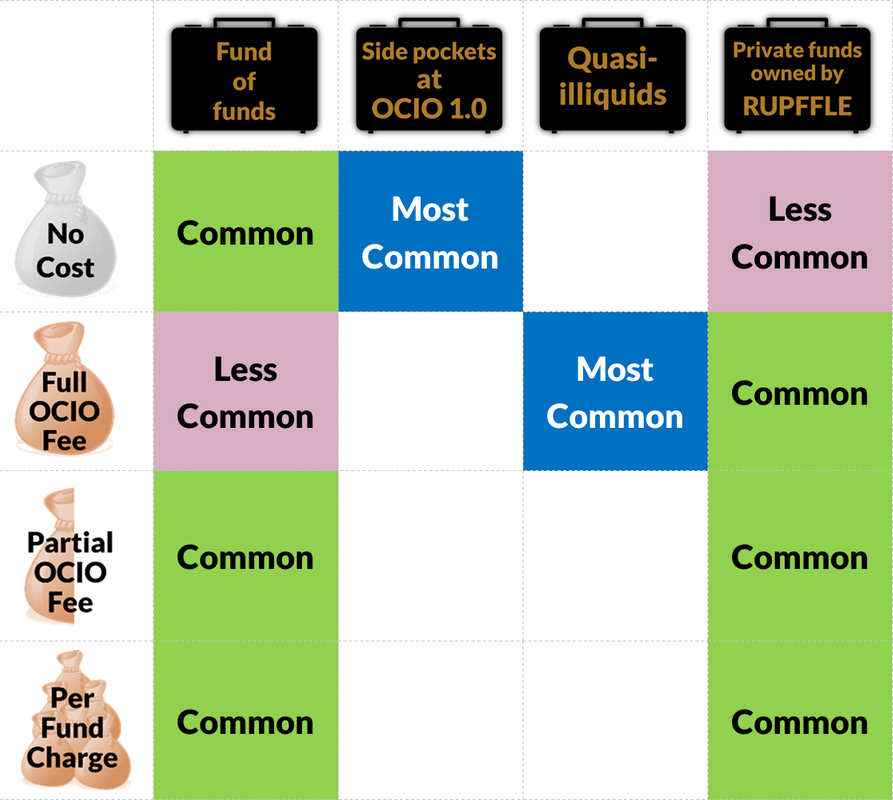

Want to share this piece? Download the paper here. Thinking of hiring an outsourced Chief Investment Officer (“OCIO”)? You’re not alone. OCIO was already on a strong growth trajectory, with global OCIO assets increasing from less than $100B in 2013 to almost $2T in 2020 according to Pensions & Investments. The 2020 market turmoil and global pandemic have accelerated the trend, with over 50% of OCIOs in a recent survey by Chestnut Advisory Group revising their growth projections upwards post-pandemic (for more results from Chestnut’s survey, see their excellent webinar). Some organizations are considering an OCIO model for the first time (we call these OCIO 1.0), while others already adopted the OCIO model but seek to change providers (OCIO 2.0). As search professionals, we at Alpha Capital Management work with a fair amount of organizations seeking OCIO 1.0. We devote an entire project segment, “Explore,” to educating committees and organizations on what to expect from OCIO models, looking at everything from governance to investments to operations. Lately, we are getting more and more inquiries from organizations that already have an OCIO and are seeking a new one – OCIO 2.0. The nice thing about OCIO 2.0 is that the education process should be lighter. Since the organization’s committee is already familiar with the governance model as well as the benefits and features of the OCIO model, our “Explore” phase can be curtailed or eliminated. OCIO 2.0 should be a walk in the park (masks on), right? Wrong. Unfortunately, OCIO 2.0 comes with many considerations. The devil, it turns out, is in the details. For example, the OCIO universe has expanded significantly. Clients considering an OCIO today have more providers and models to learn about and choose from. Also, exiting an OCIO is not as easy as entering an OCIO in many cases. Our OCIO 2.0 clients have a great deal more to consider in terms of liquidity, asset transitions, and timelines as well. The most overlooked complication for OCIO 2.0, though, might just be legacy illiquid assets. This is especially true for our non-profit clients, who almost always hold investments in private investments like real estate, private equity, or private debt. Legacy illiquid assets complicate the transition process to OCIO 2.0. Additionally, the industry has not yet settled on a standard pricing model for many of these assets. It is crucial that organizations consider these assets in their OCIO searches. In this Insight, we hope to shed some light for clients and OCIOs alike on special considerations for legacy illiquid assets. What is a legacy illiquid asset? Cash is king. In a perfect world, an OCIO starts a new client relationship with a blank slate (100% cash or easily liquidated assets). Some OCIO models allow for more or less customization of asset allocation and manager holdings within portfolios, but it’s fair to say that the OCIO model works best when the OCIO, an investment expert, brings the full weight of that investment expertise to bear in designing and implementing a portfolio. Ten years ago or more, it was often true that clients moving to an OCIO model for the first time (OCIO 1.0) did bring mostly cash and liquid securities. Today, the picture looks quite different, especially in the non-profit world. Private equity and other illiquid assets with a long lock-up period have been embraced in big way. According to the National Association of College and Business Officers (NACUBO) via Institutional Investor, “the share of total U.S. nonprofit money invested in alternatives has doubled in the past 15 years.” An average 27.7% allocation to alternatives like private equity across endowments and foundations in 2003 had ballooned to 52% by 2018. As Bloomberg Businessweek put it, “private equity managers won the financial crisis.” And private equity and its brethren far outlive a typical investment committee member, consultant, or OCIO. Therein lies the problem. Let’s follow a fictional non-profit, The Rich Uncle Pennybags School for Financial Literacy and Education (“RUPFFLE”), through their OCIO journey to see how legacy illiquid assets are typically handled. In 2010, RUPFFLE hires its first OCIO and gives over management of its $200M portfolio (all liquid assets) to OCIO 1.0. OCIO 1.0 believes in a heavy weighting to alternatives, and it invests RUPFFLE in a diversified portfolio with 20% in illiquid assets. Unfortunately, RUPFFLE’s portfolio fails to grow, and the organization decides to change OCIOs in 2020. After a search, RUPFFLE hires OCIO 2.0 and transfers assets to the new firm. However, RUPFFLE cannot liquidate the $40M that OCIO 1.0 invested into illiquid assets. OCIO 2.0 instead receives $160M in liquid assets plus a suitcase with $40M in illiquid assets. We will take a look at how this suitcase of illiquid assets is handled by OCIO 2.0 and RUPFFLE over the next few sections. What's in the bag, sir? OCIOs want cash to invest; instead, they receive suitcases. Not only must OCIO 2.0 build around illiquid assets from an investment standpoint, but illiquid legacy assets also require operational support and specialized transition management that OCIO 2.0 must supply. The amount of additional support needed depends on what’s in the suitcase. Here are the most common illiquid assets in the OCIO space. We’ll look at each in turn. Side pockets at OCIO 1.0 and Fund of funds In addition to traditional fund-of-funds run by dedicated companies, some OCIOs offer internal fund-of-funds for clients in illiquid asset classes like private equity. Other OCIOs pool all clients together into one vehicle; when a client leaves, that client gets cash back from the pool for the value of the liquid investments but continues to own a proportion of the illiquid assets (a “side pocket”). Although these assets are illiquid until the fund unwinds, OCIO 1.0 (or the fund-of-funds manager) retains responsibility for monitoring the underlying managers as well as managing capital calls and distributions for the underlying investments. Therefore, OCIO 2.0 has limited responsibility for the assets, other than fulfilling capital calls and reinvesting distributions on the fund-of-funds. Quasi-illiquids These assets are subject to some lock-ups but allow clients to exit before the fund unwinds. Hedge funds are a perfect example, offering quarterly liquidity in many circumstances. Another example are OCIO’s internal fund-of-funds for clients in liquid or quasi-illiquid asset classes. Quasi-illiquids present a transition problem, but they don’t stick around forever. OCIO 2.0 must plan for the liquidation of these assets according to each fund’s terms and conditions. As the assets are liquidated, the OCIO can invest them into the portfolio. Private funds owned by RUPFFLE Direct private investments that clients like RUPFFLE own are the trickiest for OCIO 2.0 to manage. Not only does OCIO 2.0 becomes responsible for managing the capital calls and distributions, but OCIO 2.0 usually takes on responsibility for monitoring the underlying managers. A direct private equity program often has a large number of individual line items as well (perhaps 10-80 individual fund investments), multiplying the operations work for OCIO 2.0. Baggage fees If you thought airlines were the only ones who charged baggage fees, think again. Costs multiply to build back office operations and customize portfolios around the suitcases of illiquids, and the OCIO provides services on these assets, so it seems only fair that there is an associated cost. However, the structure and level of fees vary widely among OCIOs. The most common question OCIOs have for our search professionals at Alpha Capital Management today is, “what is the going rate for legacy illiquids?” Dearest OCIOs, this section is for you. We take a look at the four most fee structures here: No Cost (RUPFFLE pays OCIO fee on $160M) Some OCIOs consider managing around legacy assets to be the cost of doing business and provide basic capital call/distribution services at no cost. The number of legacy positions serviced under this fee structure may be capped, with charges beginning once that threshold has been reached. Full OCIO Fee (RUPFFLE pays OCIO fee on $200M) Some OCIOs offer full service on legacy assets, including ongoing monitoring, due diligence, and active management of positions where appropriate (for example, seeking out opportunities in the secondary markets to liquidate positions, or taking an active LP role). OCIOs believe that there is no difference in the level of service provided on these legacy assets vs. the investments the OCIO itself has made; therefore, the cost is the same. Partial OCIO Fee (RUPFFLE pays OCIO fee on $160M plus reduced OCIO fee on $40M) The rationale is similar for the OCIOs who charge a full fee, in that servicing these assets do increase costs for OCIOs. However, the total level of service required for legacy illiquid assets is perceived to be less than for investments that the OCIO has made and takes full responsibility for, and therefore, the OCIO charges a lesser rate than for its own investments. Per Fund Charge (RUPFFLE pays OCIO fee on $160M plus $2,000 per illiquid fund in the $40M suitcase) By pricing the operational services provided on legacy assets at a completely different rate than assets where the OCIO has investment authority, this pricing structure clearly distinguishes between operational and investment duties of the OCIO. Cost per line item is typically low, which can result in significant savings for portfolios with only a handful of legacy line items, but the charges can add up quickly for fully built direct private portfolios. Cheat sheet Although the OCIO industry has (for the most part) not yet settled on a standard for legacy asset pricing, we can point to some general trends that we at Alpha Capital see emerging over multiple RFP cycles for our clients. Here are the fee arrangements we see the most often for each type of legacy illiquid asset at OCIO 2.0: Remember that the table above only looks at fees charged by OCIO 2.0. OCIO 1.0 may continue to assess fees on legacy illiquid assets (or start charging new fees) that it retains after termination. This may seem obvious for side-pocketed assets, but it is often a point of confusion on fund-of-funds. Read the offering documents carefully for any pooled vehicles to better understand all terms and conditions. As always, it is crucial for organizations to clarify fees and services during the search process. Toward an industry standard As a relatively young industry, outsourced CIOs are still working to create industry standards. Unfortunately, this creates a great deal of confusion for organizations like our fictional friend, RUPFFLE. In the meantime, it is crucial that organizations perform comprehensive due diligence when hiring an OCIO… even if it’s OCIO 2.0. We at Alpha Capital have written previously about other hot topics such as performance and fiduciary responsibilities. Our hope is that the industry continues to move towards a consistent standard for providing services on legacy assets at a fair price. (We are casting our vote for the “partial OCIO fee” model.) Bonus: due diligence questions for legacy assets As a special thank you for reading our insights, here are four questions RUPFFLE and its peers should ask when hiring OCIO 2.0:

5. If we terminate our OCIO relationship, what fees will you continue to assess and on which assets? Want to share this with your colleagues? Download the report here.

Embracing a New Technology for Productive Meetings  At the start of 2020, who could have predicted that the somewhat staid world of investments, with its love of in-person meetings and on-site due diligence, would have to wholeheartedly embrace remote work, and with them, remote meetings? Several months into the year, our team at Alpha Capital Management has logged hundreds of hours on Zoom, BlueJeans, WebEx, and their remote meeting brethren. We’ve used them for everything from OCIO search finals to informal team meetings. And in that time, we’ve not only learned how to maximize this video platform, but we’ve gathered feedback from a wide variety of institutional investors, OCIOs, asset managers, and consultants on how to make the most of remote meetings. Remote meetings have their downsides, to be sure. Following Murphy’s Law, internet connections seem to be at their most unstable in the middle of important finals presentations. It is difficult to build rapport and impossible to make eye contact. And almost every meeting gives us a new opportunity to experience what Russell Investments dubbed the “Top 5 Most Painful Phrases in a Virtual Meeting.” (For more on that, see Additional Resources). But remote meetings also have plenty of benefits. They are easier to schedule and don’t require eight hours of travel for a one-hour meeting. This makes it easier for senior leaders to attend finals they would otherwise miss, and allows clients to meet with a broader group of professionals at any given firm than is practical to fly in for a meeting. It’s hard to say how long any of us can expect to interact with clients solely through video conferencing. We may as well make the most of it. In this research paper, Alpha Capital Management offers our best practices for successful video conferencing. Here are our top tips:

Tip 1: It Takes a Village Remote meetings can quickly descend into chaos, with parties constantly interrupting each other (“No, you go…”) and participants trying to troubleshoot technology issues live (“Can you hear me now?”). While one extremely organized person can manage a meeting, the best meetings involve more than one organizer in key roles. Here are three to consider: Super Moderator The Super Moderator is tasked with starting the meeting, giving the (virtual) floor to the appropriate party, setting the procedure for questions (whether that is using the chat function, speaking up, using a virtual icon to raise hands), and ensuring that all participants have a chance to ask questions. Make sure Super Moderator is well versed in your virtual meeting technology. He or she should know (at a minimum) how to set up a meeting, use “waiting room” or “admit to meeting” functions, mute and unmute participants, and allow participants to screen-share. Technical Support No one wants to delay a meeting for ten minutes while one participant provides live technical support to another. Hand that responsibility off to someone who isn’t an active meeting participant. Make sure each meeting participant knows how to reach Technical Support, too. Provide a day-of contact number and email for any last-minute troubleshooting. Screen Sharer If your firm intends to share your screen and display live content, appoint one person to manage the presentation. Ideally, this is someone who has a low-to-moderate speaking role—and it certainly should be someone with a strong internet connection. Screen Sharer should disable pop-up notifications such as email alerts that might distract from the meeting or display confidential information. The presentation to be shared should be ready to go on the screen (no fumbling through personal files and vacation photos live, please!). Lastly, Screen Sharer should be well versed in the technology, especially using special features such as annotate or pause screen share (useful for pulling up another document or file without everyone watching you click around). Tip 2: Back Up Your Backups  In a remote meeting, it is much harder to control the variables for participants than for an in-person meeting. Don’t try to eliminate the variables— embrace them. For one example, let’s think about sharing a live presentation on screen. This works for participants who log onto the meeting using a device with a screen, but not for participants joining by phone. Send out all presentations in advance to participants via email or through the calendar invitation, so everyone has the material at their fingertips. Provide multiple ways for participants to join the meeting as well. Most video conferencing systems allow for computer, tablet, or phone access with or without video connectivity. And if you follow our first tip and appoint a Screen Sharer, back up this role too! Make sure more than one participant is ready to share the deck in case of last-minute challenges Tip 3: Brevity is the Soul of Video Conferencing The culmination of the Alpha search process is the finals presentation. OCIOs and consultants who have cleared months of due diligence present in person to the Committee. Our typical finals schedule takes about 5 hours: 3 one-hour presentations by finalist candidates with brief 10-15 minute breaks in between, bookended by 30-minute (or longer) discussions to kick off and wrap up the meeting. This is a tried-and-true formula for in-person meetings but is extremely taxing over video. The human brain is wired for in-person connection. Research shows that sitting at a kitchen table interacting with a computer is much different than sitting at a conference table interacting with peers. This phenomenon even has its own name, Zoom fatigue. Keep this in mind while scheduling video meetings, and try to break them up more than you would an in-person meeting. We suggest that no video meeting last longer than 2.5 hours, including breaks. If scheduling difficulties don’t permit multi-day finals, try to schedule longer-than-normal breaks in between presentations to give participants a chance to stretch and walk around. This tip also applies to the presentations themselves. Video conferencing has a few key disadvantages over in-person meetings. A good presenter watches the audience for non-verbal cues and adjusts the presentation accordingly, understanding when to belabor a point and when to skip ahead to more interesting material. In the absence of non-verbal feedback, it is easy to ramble. Be very deliberate in your presentation. Pause often, allowing participants enough time to jump in with a question or a prompt to move ahead. Allow time for technical difficulties and for plenty of questions. Organization is important for any presentation; remotely, it is crucial. Tip 4: Easy on the Eyes  No one expects your video meeting to resemble a Hollywood movie (or even Saturday Night Live from Home). But there are a few simple ways to improve the quality of video meetings without buying a green screen or taking acting lessons from Brad Pitt. First, try to avoid the meeting opening with a blank, dark screen. Your participants should have visual cues that they have joined the meeting successfully, and that they have joined the right meeting. If the meeting participants are using video, the Brady Bunch view of familiar faces can provide that cue. Another option is to share a welcome screen at the beginning of the meeting, displaying the meeting name and perhaps a brief agenda. Next, put some thought into your video setup. As noted in the previous tip, non-verbal cues are an important part of human communication. Although cues like body positioning, hand gestures, and eye contact are limited on video call, having a well-lit shot that shows your facial expressions adds back something that is otherwise lost. Putting a little thought into your video setup goes a long way. An ideal spot would have lots of light (both in front and behind you) and a good head-on view of you with little else in the foreground. Don’t forget a comfortable chair. Lastly, put some thought into your wardrobe. Video conferences can have a casual air about them, with participants joining in from home environments and often dressed down. We recommend that presenters dress up to add that little bit of extra professionalism. And please, wear pants. We’ll know if you don’t. Tip 5: Roll With the Punches This tip was initially called “Practice Makes Perfect.” After three and a half months of virtual meetings, however, the entire planet has had plenty of practice. We should all be expert-level virtual meeting participants at this point. And yet, very few video conferences go off without a hitch, even today. It may not surprise you to hear that our most successful virtual meetings have this in common: participants are comfortable with the technology. The proliferation of video platforms, settings, and features can make it a challenge for participants to know the ins and outs of each technology—and that’s putting aside the fact that some participants are not as skilled as others with technology in general. By all means, work with your participants to get them comfortable with your video platform of choice. Encourage them to test-drive the technology on their own or with Technical Support (see Tip 1), offer quick-start guides that highlight key features (see Additional Resources, below), and practice, practice, practice. That being said, a little bit of grace goes a long way. Accept that technical issues might crop up. Kids might make a cameo, the doorbell might ring in the middle of a meeting, or the mute function just might not work like it should. Address them, work around them, and move on. It doesn’t have to be perfect. We’re all in this together Want to Learn More? Additional Resources

Want to download a copy of this report to share? Click here.

Alpha Capital Joins with Nasdaq to Create OCIO Tools to Increase TransparencyNew suite of indices provide valuable tools for institutional investors to measure outsourced Chief Investment Officers

Alpha Capital Management, a best-in-class OCIO search provider, announced the Alpha Nasdaq OCIO Indices, a suite of tools that empower institutional investors with valuable insights for assessing Outsourced Chief Investment Officer (OCIO) services. Alpha Capital collaborated with Nasdaq in developing the product suite, which provides much-needed transparency to a traditionally opaque industry. The indices give institutional investors and OCIO firms the ability to objectively measure their performance against peers across different risk profiles, client types and asset mixes. Alpha Capital developed the indices along with Nasdaq and leading OCIOs. Outsourced Chief Investment Officers are third-party service providers that serve as chief investment officers for institutional investors. They assume the legal and fiduciary responsibilities of a Chief Investment officer but provide the services externally. A report by Charles Skorina & Company estimated OCIO assets under management grew to $2.38 trillion this year. The Alpha Nasdaq OCIO Indices provide a reliable framework for institutions to objectively measure the performance data of these providers, which has traditionally been difficult to assess. The tools are a meaningful step towards establishing an industry-wide standard for OCIO performance evaluation. The indices are based on account-level return streams, asset allocation and metadata anonymously reported directly by OCIO firms. The Alpha Nasdaq OCIO indices compile this anonymously reported data to construct a family of indices that represent the broad OCIO market along with variations of the OCIO market to more appropriately reflect the nuances across sub-categories, such as client type and risk profile. “For too long, outsourced CIOs were measured by a wide variety of metrics that didn’t suit every player,” says Brad Alford, of Alpha Capital Management. “The Alpha Nasdaq OCIO Indices help create a level playing field and bring some transparency and uniformity to how OCIOs are measured. This is a game changer for institutional investors looking into outsourcing CIO functions and for OCIOs.” “Market access and transparency are two of Nasdaq’s key missions,” said Terry Wade, Senior Vice President of Business and Product Development with Nasdaq’s Global Information Services. “Our work with Alpha Capital Management brings much-needed transparency and makes the OCIO space more accessible.” For more information, please visit www.AlphaNasdaqOCIO.com. The outsourced Chief Investment Officer ("OCIO") service model has a lot to recommend it. Institutional portfolios grow more and more complex, putting strain on corporate benefits departments and non-profit volunteer boards. Institutional clients need more help, and the marketplace is busily coming up with solutions to meet strong client demand. Investment consultants have been very successful in offering OCIO solutions to clients. Indeed, three of the five largest OCIOs globally are investment consultants. The OCIO model offers several attractive features to investment consultants, but it also comes with challenges. We address three such challenges in this blog post: performance, conflicts of interest, and operational capabilities. Challenge #1: Performance A constant source of frustration at our firm during our searches is trying to get an investment consultant to quantify the value of their advice (one reason we think they can’t charge as much as they should). Who is responsible for returns in a non-discretionary investment relationship where a board of directors makes decisions based on the advice of their investment consultant? The board selected the asset allocation, but the consultant did the asset allocation study. The board picked the managers, but the consultant recommended them. It’s hard to parse out who is responsible for performance in an advisory relationship. With OCIO though, performance responsibility rests squarely on the consultant-turned-OCIO, good or bad. Take a look at this statistic from Cerulli’s most recent OCIO research study: 100% of non-profit respondents list investment performance as the #1 thing an OCIO must deliver. We don’t believe that consultants have fully embraced responsibility for performance yet. When prospective clients ask for performance, a common refrain from consulting firms is, “we cannot show an OCIO track record because every client is different.” Clients may have different goals, but relative performance or composites of clients with similar goals should capture these. (As a side note, without an industry standard like Global Investment Performance Standards (GIPS) being used, even composite returns must be viewed with suspicion. But it is still a step in the right direction! For more on GIPS, see our 2018 blog post). Institutions must be able to see a track record in order to judge whether an OCIO is likely to deliver their #1 expectation, investment performance. OCIOs must accept responsibility for investment performance. Challenge #2: Operations One reason OCIO is so popular for non-profits under $250M (who, as a rule, are chronically understaffed) is operations. Investment portfolios have gotten extremely complex. Paperwork can be a nightmare, especially for alternatives with partnership agreements, side pockets, capital calls, distributions, and everything else to manage. Operational efficiency is a big selling point for OCIO solutions, but it’s also one where consultants don’t have a natural skill set - they must build it or buy it. It also presents an interesting conundrum for consultants selling OCIO solutions to investment committees. Investment committees make the investment decisions, but they usually don’t know how the sausage is made. Operations staff handle portfolio implementation, but they don’t sit on investment committees. Consultants tie investment discretion and operational authority together into one OCIO package, but committees may view these as completely separate decisions. And committees may not want their consultant to sell them new and expensive investment solutions, which brings us to our third challenge. Challenge #3: Conflicts of Interest One thing the institutional investment consulting community does exceptionally well is align their interests with their clients. These long-term relationships are built on the client’s ability to trust their consultant. Serious conflicts of interest (like accepting money or Masters tickets from asset managers, earning 12b-1 fees and other commissions in addition to advisory fees, or selling proprietary products) are rare in the consulting industry these days, and those that exist are typically well disclosed and well managed.

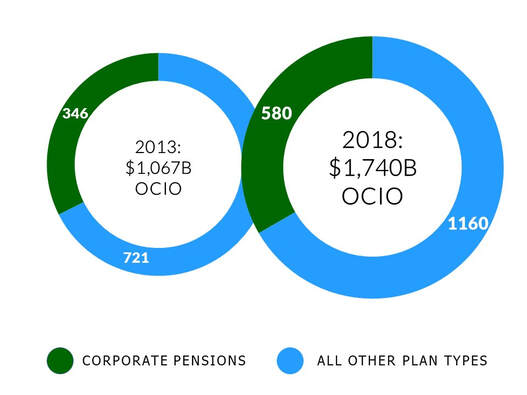

Offering OCIO services alongside non-discretionary services, however, opens the door to brand new, serious conflicts of interest that must be managed. Now consultants have something to sell non-discretionary clients, OCIO, that increases revenue. Consultants are building proprietary products in an attempt to scale OCIO solutions – another potential conflict. Consultants are held wholly responsible for OCIO track records but not for non-discretionary client performance, incentivizing them to allocate top quartile, limited capacity managers to OCIO clients in the hopes of improving their performance record. The fee differential between non-discretionary and OCIO clients incentivizes firms to allocate their best resources to the line of business with higher revenue potential. These are just a few examples. The OCIO industry is just beginning to grapple with these serious conflicts. Consulting firms must find a way to offer OCIO services without breaking the trust of their clients. We encourage consulting firms to think carefully about the potential conflicts of interest inherent in offering OCIO alongside traditional non-discretionary services, and to proactively and transparently address those issues with well-designed policies. December performance woes may be forgotten by mid-January, but clients have a long memory for bad behavior. It is time for the OCIO industry to evolve. This blog post is adapted from our research report, "Clients Give Consultants a Green Light for OCIO."  Virtually unheard of a decade ago, the outsourced Chief Investment Officer (“OCIO”) marketplace has exploded. OCIO providers had more than $1.7 trillion in fully discretionary or partial discretionary assets under management (“AUM”) in early 2018, on a projected base of over $6 trillion total “outsourceable assets.” OCIO assets in the US have grown significantly over the past decade, and OCIO assets under management are expected to continue to grow at low double-digit rates for the foreseeable future, according to projections from Cerulli Associates and Pensions & Investments. In fact, Cerulli projects that US OCIO assets will increase by $671 billion over the next five years alone. With such attractive growth prospects, it is no surprise that all sorts of firms are entering the market to offer institutional OCIO solutions. Alpha Capital Management tracks nearly 100 different firms offering OCIO services. Many of the OCIOs who have been most successful in attracting clients are consultants. In this blog post, Alpha Capital Management offers our thoughts on the three primary reasons investment consultants are embracing OCIO. Our next blog post will cover three challenges that consultants-turned-OCIOs face. Reason #1: Clients Want It OCIO is growing because clients demand it. Why now? Let’s look at a few real-life examples from Alpha Capital Management’s search clients. A $200M frozen pension plan finally saw their funded status top 90%. The CFO was thrilled. But by the time they went to lock it in, the markets moved against them. When we were called in to do a search, the funded status was back in the mid-80s. This number was so important to the CFO that he asked finalists if it could be pushed to him daily via text message. They went OCIO. Pensions like our search client are a huge part of the OCIO market. This was true five years ago, and it is still true today. As Pensions & Investments reported in June 2018: “Large managers of discretionary OCIO assets said one of their biggest sources of new business in the past year and expected to be going forward is from corporations contemplating the fate of their defined benefit plans.” Defined benefit plans have kept pace with the massive growth of OCIO and still represent a third of the global OCIO marketplace, as shown below:

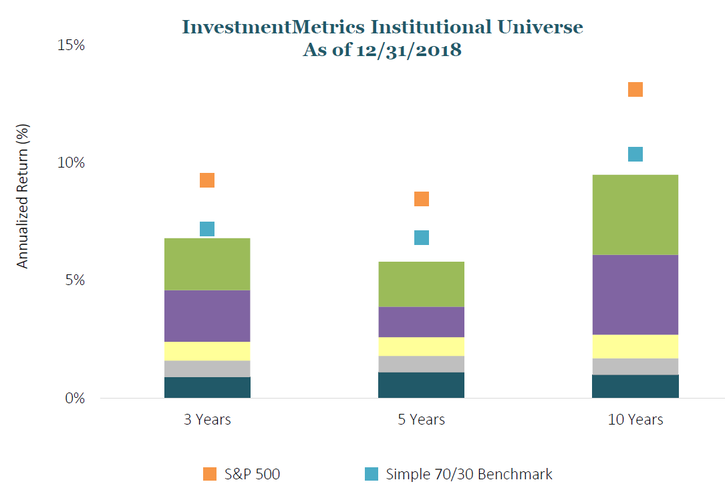

Here’s another example. We worked with a non-profit with about $500M in assets. Their returns weren’t awful, but they were below their peer group median and trailing public market benchmarks over the past 3, 5, and 10 years. “We must be terrible at managing money,” thought the board. They went OCIO. It has been a tough market cycle for diversified investors like our non-profit client. The S&P 500 has beaten InvestmentMetric’s entire institutional universe, as shown here: Of course, we are not arguing that the S&P 500 Index is a fair comparison, or even a reasonable one, for a diversified portfolio. But it is undeniably a visible, well understood, and highly discussed benchmark. Even against the simple blended index shown above, institutional portfolios have not kept up with the US market. Broad index returns may not mean as much as meeting client-specific goals and objectives, but these comparisons still matter to clients. We believe that OCIO has benefited from two massive tailwinds: pension plan sponsors who seek an improved governance model, and clients struggling with underperformance issues who seek stronger returns. Reason #2: Increased Revenue Potential The marketing pitch we hear for OCIO goes like this: “it leads to stronger governance and an improved decision-making process, and it allows investment committees to focus on strategic decisions rather than getting bogged down in the details of running a complex portfolio. The service model bears an increased cost to compensate for the additional fiduciary liability of the OCIO.” Consultants may not charge enough for advisory work (although our clients disagree). Try going to your advisory clients and asking for a 100% fee increase – you’re more likely to get fired than to get a client to agree. OCIO, though, has given consultants the opportunity to reset the market perception of value. An institution may be willing to pay twice as much for OCIO. This is an important factor in the explosion of OCIO offerings by consultants. Reason #3: Scalability OCIO also offers an attractive opportunity for consultants to grow more quickly using scalable solutions. Traditional investment consulting services are hard to scale. Portfolio management can be simpler and more scalable under an OCIO model. Instead of a consultant with 10 clients performing 10 individual asset allocation projects and 10 manager searches with 3 candidates per search, an OCIO does one asset allocation project and hires one manager per slot and then pushes it out to all 10 clients. It can be an attractive model from a business management perspective while offering clients a strong investment solution (and it ties back into the second point, as scalable solutions allow for higher client loads and therefore more revenue). No Wonder Consultants are Embracing OCIOThe relationship between a client and an investment consultant is a long-lasting one, and clients place a great deal of trust in their consultants. It is no wonder that clients are approaching their investment consultant as they try to navigate increasingly complex governance considerations in a challenging market environment. Consultants are well placed to offer OCIO solutions to these clients seeking more help, and indeed, we see that they are successfully doing so.

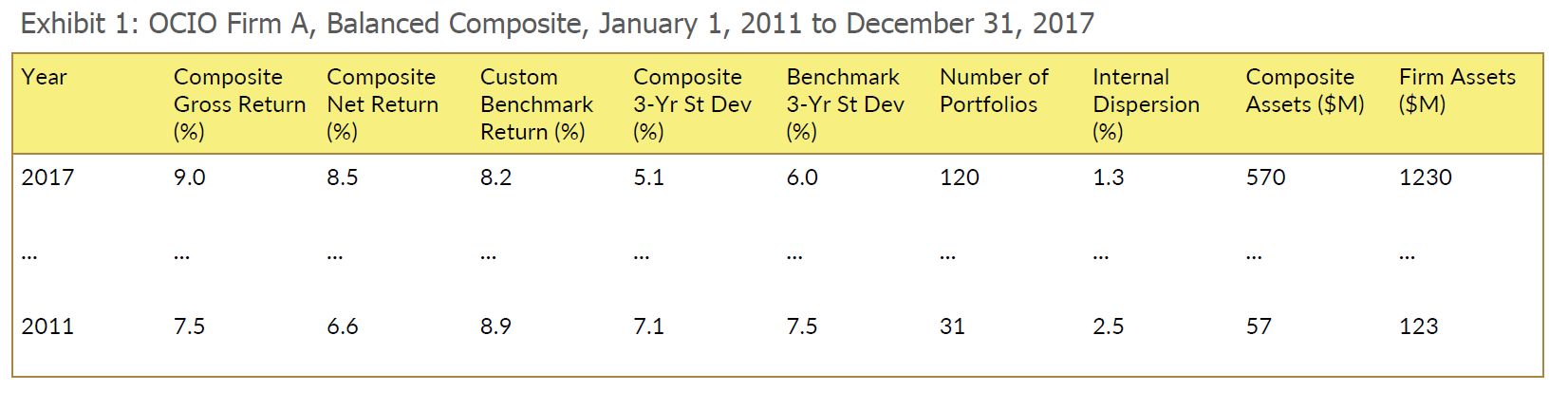

Still, we believe consultants are finding OCIO to be a two-edged sword. With the benefits of higher fees and a more scalable service model come several key challenges. In our next blog post, we will focus on three main ones: performance, operations, and conflicts of interest. This blog post is adapted from our research report, "Clients Give Consultants a Green Light for OCIO." As outsourced Chief Investment Officer (“OCIO”) solutions become more popular with institutional clients, the need to compare firms on a quantitative basis grows greater. If you’ve spent any time talking about the OCIO model with Alpha Capital Management, you’ve likely heard us mention GIPS compliance as an issue. Performance is one important way to draw clear comparisons between investment managers (though, of course, it is not the only factor to consider). Most investment managers in traditional asset classes, especially those who work with institutional clients, claim compliance with Global Investment Performance Standards (GIPS), a globally accepted methodology for calculating and presenting performance information. Prospective clients are able to directly compare investment manager results to measure skill (i.e. alpha). GIPS is not as common yet in the alternative investment space, although that is expected to change in the near future with many hedge funds working toward GIPS compliance. The CFA Institute has been working on a project called GIPS 2020 aimed at improving the standard and increasing adoption, and it is expected to propel adoption of GIPS among alternatives managers. We hope it does the same with OCIOs. We request performance information in our RFPs, but it is a highly imperfect metric. Traditional investment consultants are not usually compliant with GIPS, and performance varies widely between clients due to varying investment policy restrictions, use of alternative assets, individual investment managers, and whether the client implements the consultant’s advice. Many firms provide us with representative account data, which may or may not be relevant to our client. Although some OCIOs invest client assets as a pool where it is very easy to show audited performance, customized OCIO providers face the same issues that traditional consulting firms do: clients have different investment restrictions, different managers, and different objectives. That being said, as OCIO Strategic Investment Group recently said “Yes, OCIOs Can Be GIPS Compliant!” What is GIPS Compliance?GIPS is an established set of principles that standardize the calculation and reporting of investment performance. The GIPS standards are voluntary and based on the fundamental principles of full disclosure and fair representation of performance results. GIPS allows investment management firms to quantify and communicate their performance without misrepresentation. Reference the Global Investment Performance Standards Handbook from the CFA Institute for more information on the standards, which is available for download at the CFA website. Any investment management firm can follow the guidelines set forth by GIPS when calculating its track record, but only firms that manage discretionary assets can claim compliance with GIPS. Compliance cannot be attained by a single product. A firm must follow all requirements of the GIPS standards across all of the firm’s products, or else it may not claim compliance. Moreover, each and every client must be included in one of the composites. The CFA Institute’s GIPS Standards website lists more than 1,500 firms who claim compliance. To date, few OCIOs are among them. Why is GIPS Compliance Useful for OCIO Searches? Simply put, an institution’s ability to judge the OCIO’s ability to beat their benchmark over time, with comfort that the numbers are not cherry-picked or massaged, is paramount in selecting a qualified OCIO. There are several complicating factors to consider, however. Some OCIOs use “building blocks,” where they establish track records for asset class composites like global equity. Examining those records helps gauge skill in manager selection (and to some extent, the ability to combine managers). But what about asset allocation? Unfortunately, looking at building block records doesn’t show if an OCIO has skill in asset allocation, either strategic or tactical. A true GIPS composite gives the institution valuable insight into the ability of an OCIO to manage a total portfolio. GIPS compliance also helps to compare firms on an “apples to apples” basis. In the searches Alpha Capital Management runs for large institutions, we receive performance information that is all over the map. Some firms send us gross numbers, many send us gross of their fee but net of the underlying manager fees, and very occasionally, we get “net-net” numbers (meaning net of underlying management fees AND net of any OCIO fees, representing the end client performance). GIPS would simplify this greatly. Exhibit 1 shows a sample GIPS compliant presentation. It is clear why this is valuable. Not only does the recipient have performance information, but he also has key information necessary to verify the quality of the data going into that calculation. There are some caveats. As discussed earlier, a firm claims compliance with GIPS. An individual strategy cannot be GIPS compliant; every strategy at the firm must be assessed and calculated in line with GIPS, and every account must be put into a composite. For OCIOs with asset management divisions, claiming GIPS compliance can be a very complicated, time consuming, and expensive endeavor. It also reduces a firm’s ability to be flexible in regards to how it shows performance, as it locks the firm into one set method of calculation (even for issues where GIPS allows some leeway, such as in the treatment of legacy client assets, the firm must choose a path and stick to it). There are also many flavors of OCIOs. Some OCIOs offer significantly customized solutions across their client base, while others offer a single pooled investment strategy that all of their clients use. For the latter, GIPS compliance is much more straightforward than the former. What are the Market Trends? We’ve been loudly complaining about the lack of GIPS compliance by OCIOs for quite a long time. For reference, we wrote a piece last summer in which we remark, “it’s ironic that consultants who would never hire an investment manager without a track record ask to be hired without providing their own” (Outsourced CIO: Not a Silver Bullet). We can also point to a recent survey conducted by eVestment and ACA Compliance Group, which showed that three quarters of investment consultants will not consider managers that don’t claim compliance with GIPS for their performance data some or all of the time. (see FundFire's "No GIPS? No Mandate for Most Managers: Report" by Mariana Lemann from August 16, 2018)

In our own OCIO searches, our institutional clients have been focused on performance as a differentiator between firms, and they have been frustrated by the complexity of analyzing the data they receive. This issue matters to the institutional investors who allocate to OCIOs and have the power to demand transparency. We believe that the client demand for transparency and comparability between providers will lead to GIPS standards being more widely adopted by OCIOs. We’re happy to see already that more OCIO firms are talking about GIPS compliance or making progress toward claiming compliance. Strategic Investment Group was an early adopter, as was Angeles Investment Advisors. Highland Associates and Aon recently announced GIPS compliance, and we have spoken to several other OCIOs or consulting firms who are in various stages of reviewing, calculating, or claiming compliance with GIPS. We firmly believe that the industry will reach a “tipping point” where the major players are GIPS compliant, and competitors must follow their example to stay relevant. The move toward transparent, verifiable performance calculations is a great thing for investors, and we highly encourage it. We applaud OCIO and consulting firms who have recognized this and are taking action. We hope to be able to exclude firms who do not claim compliance with GIPS or have audited numbers from our OCIO searches, but right now, there are not enough compliant firms to do so. As the OCIO industry develops, institutionalizes, and evolves, we think that adopting clear, verified standards of performance is the best possible way for institutions to differentiate between OCIO providers’ performance. We will do all we can to usher in this new era of transparency. Want to download a copy of this report to share? Click here. Why Hire a Search Consultant Are you thinking of engaging a search firm to help you run a consultant search or OCIO search? You’re not alone. Although practically unheard of five years ago, the outsourced CIO (“OCIO”) model, in which a committee hires an investment manager to oversee the portfolio rather than soliciting advice from an investment consultant, has exploded onto the institutional landscape and has garnered significant interest from a wide range of institutions. The investment world has gotten increasingly complex, and more and more boards, committees, and organizations are unsure of their ability to truly fulfill their fiduciary obligation to the assets they oversee (at a time when fiduciary lawsuits are on the rise). OCIO models offer a solution for organizations struggling with a lack of internal resources, a desire to improve governance process, and the need to improve risk-adjusted returns. The traditional investment consulting model has evolved to fill these needs, but at the same time, it has complicated the investment advice landscape. This added complexity has led to a new niche service provider: the consultant or OCIO search firm. These are sometimes referred to as “OCIO Search Consultants,” but we believe this terminology is confusing as consultants historically provide investment advice while OCIO search firms provide very targeted services to enable organizations to vet investment advice and implementation providers. We like to say, “don’t call us a consultant!” OCIO search firms exist to guide organizations through the search process, everything from designing the RFP and developing search criteria to identifying candidates and analyzing the responses. More than one-third (34%) of providers polled in a recent industry survey by Cerulli used a search firm, and this number continues to grow. They manage the entire project from start to finish, greatly simplifying this important fiduciary process for institutions. 7 Characteristics of High Quality Search Firms

Ten Questions to Ask Search ConsultantsIt may seem silly to go through an RFP process to hire a firm to run your RFP process, but as a leading search firm, we often receive “mini-RFPs” with a handful of questions designed to compare us against our competitors. As RFP architects, it makes sense to us from a due diligence perspective. We encourage firms to consider this exercise, and to help, we compiled 10 sample questions that organizations can use to learn more about search firms.

With outsourced investment options (commonly called OCIO, which is how we’ll refer to these in the remainder of this report) becoming more popular in the institutional investment community, we have considered what types of governance issues an OCIO might be able to solve for organizations and investment committees. This is not to say that OCIO is only useful for dysfunctional committees, but it is true that we usually get calls when something is broken. Sometimes this is related to the consultant: performance hasn’t met expectations, or the client feels that the consultant isn’t proactively managing the relationship, or perhaps there has been turnover on the account. But governance is also a key concern, and many of our clients and prospective clients have wondered if OCIO could solve a nagging problem: absentee investment committees. Absentee committee member archetype Having served on the boards of non-profits and having worked with many more as consultants and endowment directors, we understand this particular governance problem intimately. It can take many forms. The serial volunteer: Bob’s biography proudly lists his participation on the boards of several well-known non-profits, but he rarely attends scheduled investment committee meetings and does not participate in most discussions or decisions. The dog ate my homework member: Susan attends scheduled committee meetings but has not done the background reading and preparation needed to add value to investment discussions; valuable meeting time is spent answering her questions. The one whose cousin is a broker: Anita loves to bring new investment ideas to the table – unfortunately, most are either too expensive or too esoteric for the committee to invest in. They also have not been vetted by an independent consultant. Valuable time is wasted both for the committee and the investment consultant researching and rejecting these investments. The pillar of the community: Anything Randall says goes, even if most of the investment committee thinks it is the wrong decision. After all, no one argues with Randall. He has been on the board for over ten years. What all of these archetypical volunteers have in common is a tendency to distract the investment committee from its purpose. Too much time is wasted in valuable committee meetings, time that is needed to set the broad direction of the investment portfolio and monitor the service providers. You can’t force grown-ups to do their homework, especially not volunteers, but political considerations usually mean that organizations also cannot simply replace problem members. Solutions for a thorny issueThere are several potential ways to handle this thorny issue, including:

Exploring Option 4 - OCIO We’ve been asked, is there really a difference between effectively rubber stamping a consultant’s every recommendation and simply giving them discretion to make the decision? In our minds, there are three primary differences: 1. The level of oversight As with any industry and any firm, some investment consultants are more skilled than others. OCIOs should have policies and procedures in place where investment decisions are vetted and approved. This ensures that one consultant doesn’t “go rogue” or make decisions that don’t reflect the best thinking of the firm. In the case of a traditional investment consultant relationship, there may not be the same level of consulting firm oversight – after all, the committee members are the additional level of oversight in the latter case. If the committee is not performing that level of oversight and simply takes all of the consultant’s recommendations on faith, a committee had better hope they have an A-team consultant guiding the portfolio! 2. The fiduciary liability You cannot pay someone to completely absorb your fiduciary liability. Full stop. The investment advisor, whether a non-discretionary consultant or OCIO, acts as a fiduciary alongside the investment committee, but the level of fiduciary responsibility differs. In an OCIO relationship, the committee does shift its fiduciary liability from evaluating the investments themselves to evaluating the advisor, but they must still fulfill this duty. The buck always stops with the committee. 3. The feeling of personal responsibility At the end of the day, a consultant who only provides advice may not feel personally responsible for the assets he or she advises on - especially if performance suffers when the consultant's recommendation is not taken. The level of responsibility is vastly higher for a named investment manager than it is for an advice provider. An investment manager lives or dies based on the results of his or her portfolio. A consultant, put simply, does not. These distinctions tilt the scale in favor of absentee committees seriously considering OCIO solutions. However, it’s important to note that ultimately, this does NOT solve the tricky problem of a checked-out investment committee in our minds. Why not? Who oversees the OCIO?The committee retains the fiduciary duty to evaluate the OCIO provider, both initially and on an ongoing basis. To evaluate investment managers (and we include OCIOs here, as they effectively act as multi-asset managers for the portfolio) requires a specialized skill set. In fact, that’s one of the main services that an investment consultant provides in a traditional, non-discretionary consulting relationship. Most investment committees include members with financial services experience or investment knowledge, often enough to set big-picture investment policy decisions and to weigh in on the long-term asset allocation of the portfolio. Investment committees are usually responsible for these tasks in either traditional non-discretionary or OCIO relationships, so we agree that this is the appropriate skill set to look for when selecting investment committee members. Unfortunately, this is not the same skill set required to perform in-depth due diligence on managers. Investment committees who choose OCIO as a bandage, therefore, have not solved the initial problem of non-engagement, and they have created a higher bar for themselves in fulfilling their fiduciary duty. The committee who was not fulfilling its previous fiduciary duty to evaluate investment managers based on advice given by a traditional investment consultant is not likely to suddenly start fulfilling this exact same role when it comes to evaluating the outsourced portfolio manager, the OCIO. The committee must consider using an additional service provider in these situations: an investment expert who can perform an evaluation of the OCIO. The value of a third-party OCIO evaluation As outsourced investment solutions become more popular for institutions such as pension plans, endowments, and non-profit asset pools, so too do third-party evaluation and monitoring services who assist the investment committee in properly selecting and overseeing the OCIO.

These providers act as a “consultant” to the investment committee, assisting the committee in performing its crucial fiduciary responsibility of selecting, overseeing, and evaluating the outsourced investment solution. Typically, this review is performed annually and should be well documented. Just as OCIOs come in many flavors, so too do OCIO evaluation services. They range from truly independent advisors, who offer no institutional investment consulting or OCIO services of their own, to investment consultants and outsourced CIOs who serve in a monitoring capacity for non-investment clients. We believe that there is great value in selecting a truly independent option, as consulting firms have a baked-in conflict of interest that can color the analysis. Just as the investment consultant should be providing advice independent of relationships with investment managers, monitors should provide advice independent of consultants. For most institutions, running an investment consultant RFP or OCIO RFP is an occasional (and painful) process. There isn’t much value derived from previous RFPs since the intervals are too far apart. Offering this as a service, we have an opportunity to constantly improve and evolve our search process, including the questions in the RFP themselves. It allows us to pinpoint what works and what doesn’t. With that in mind, here are five of our favorites. Update: we're pleased to announce that this report was featured in FundFire on December 15! 1. What percentage of firm revenue comes from institutional consulting activity? Identify other sources (and %) of revenue. Rationale: The lines have been blurred between investment managers, consultants, and outsourced chief investment officer (OCIO) providers – especially over the past few years. Although we typically include many questions in an RFP designed to identify potential conflicts of interest, this question gives us a birds-eye view of the firm’s revenue. We use it as a way to gauge the firm’s commitment to providing traditional consulting services versus OCIO services and/or investment management services. It also alerts us of existing business lines that we may not have captured in other questions and allows us to clarify this in conversations with the respondent. 2. What is the average client-to-consultant ratio at the firm, and how is it calculated? Rationale: It was an investment consultant who clued us into the various ways this question can be answered. Some firms simply compare the number of clients to the number of investment professionals to calculate the ratio (thus including dedicated research professionals and support staff along with client-facing consulting professionals). Others only include consulting team members. One firm differentiated between lead (counted as 1 client) vs. co-lead (counted as 0.5 clients) relationships. In order to compare firms on this metric, it is important to get consistent responses and to understand how this metric is being calculated. We ask several questions about the client to consultant ratio, but this is the primary one we use for comparison. 3. Provide comments and suggestions on our current Investment Policy Statement (included with the RFP).  Rationale: What better way to evaluate a new advisor than to ask for advice in the RFP? When a new consultant is brought on board, the first step is often a review (and possibly, an overhaul) of the organization’s existing investment policy statement (IPS). Most of the time, these changes are cosmetic – for instance, a particular consultant may prefer wider bands around target allocations. But we have seen a few cases where prospective consultants identified potentially serious issues in a client’s IPS, including internal inconsistencies. Even if the organization stays with the incumbent, this question gives the organization comfort in the integrity of their IPS and documents a thorough review process with input from some of the best minds in the business. 4. How do you ensure best ideas are shared between consulting and research teams? Rationale: The bigger the firm, the more likely it is that there are consultants and researchers spread across different departments and different geographic locations. The best research capabilities in the world won’t do a client any good if the consulting team isn’t receiving, processing, and funneling this information to the client. Ensuring that there are strong processes and procedures in place to keep these lines of communication open is a way of ensuring the client benefits from the full capabilities of the firm. 5. How do you measure your success as a consultant? Provide data as support.Rationale: Much as our firm is constantly evolving and improving our RFP questions, consulting firms are evolving and improving their responses. They have carefully crafted qualitative answers to show off their skill set to the best of their ability. This question is a way for the client to quantify each firm based on the results of their advice (not an easy thing to do with consultants!). It also provides insight into what the consultants themselves think is important, which can be very helpful in setting criteria. Bonus: Here's one that didn't work  Not all of our questions are successful in helping us to evaluate and differentiate between investment consultants. Here's one we tested out that didn't work very well: What is the average client to senior consultant ratio for relationships in the following size ranges? A) Less than $100M B) $100M to $500M C) $500M to $1B D) $1B and greater Rationale: Where questions are open to interpretation and gamification (such as the client to consultant ratio), we request different data points and ask for the information in different ways. This allows us to cross-reference the responses and ensure that the answers are consistent. We used this question (unsuccessfully) in a recent RFP. We expected to see a higher client-to-consultant ratio on smaller clients (with AUM representing a crude measure of complexity) and a lower ratio on larger clients. Overall, the measure should be in line with the high-level client-to-consultant ratio. The result? 40% of the firms we asked didn’t track this data and most of the rest didn’t provide consistent information in line with expectations. One firm, for example, came back with 1:1 in every category, which we believe signified one senior consultant assigned to each relationship (i.e. the consultant to client ratio, rather than vice versa). Rather than try to reengineer this question, we simply removed it and rely on other measures to place the client to consultant ratio in context. |

Author

Anna Tabke, CFA, CAIA Interest

All

Archives

April 2022

|

Copyright © Alpha Capital Management