|

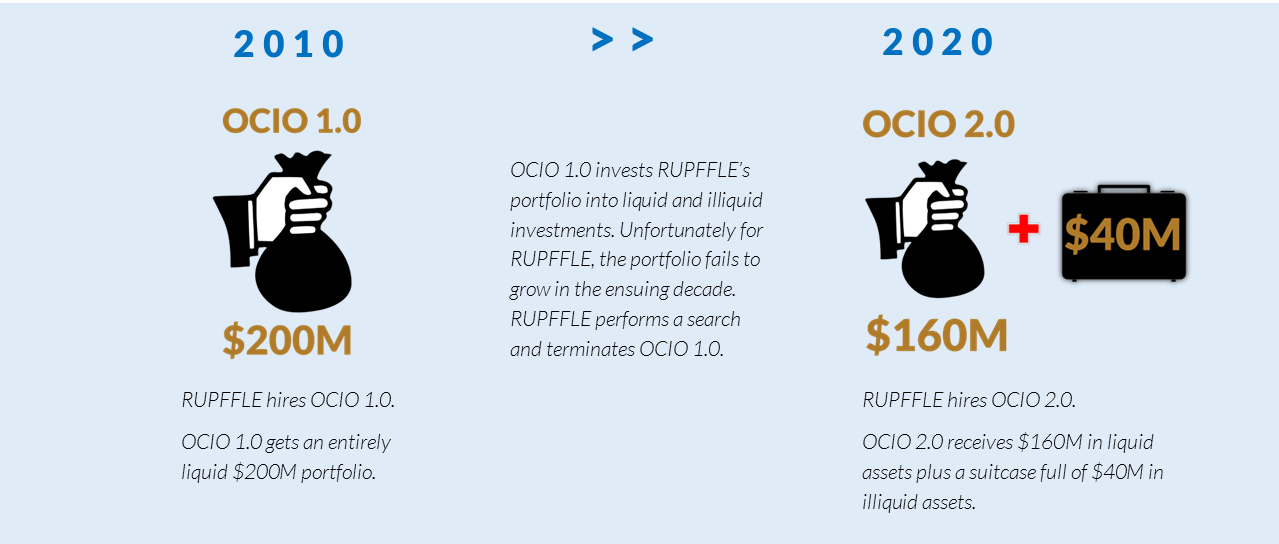

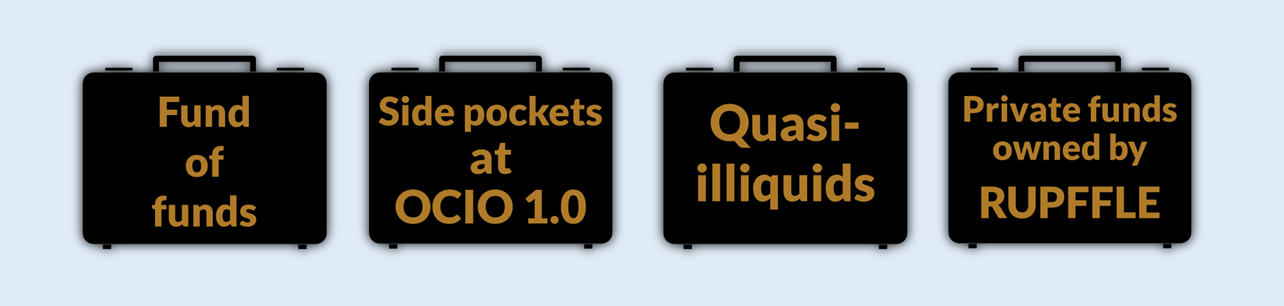

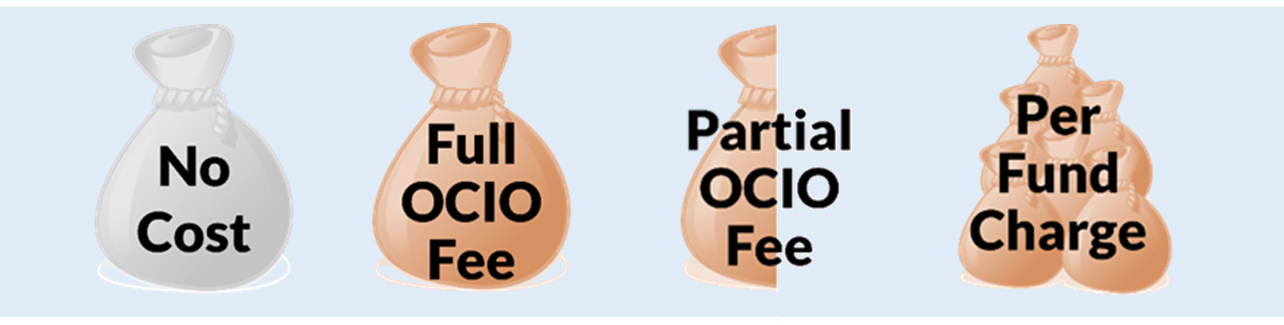

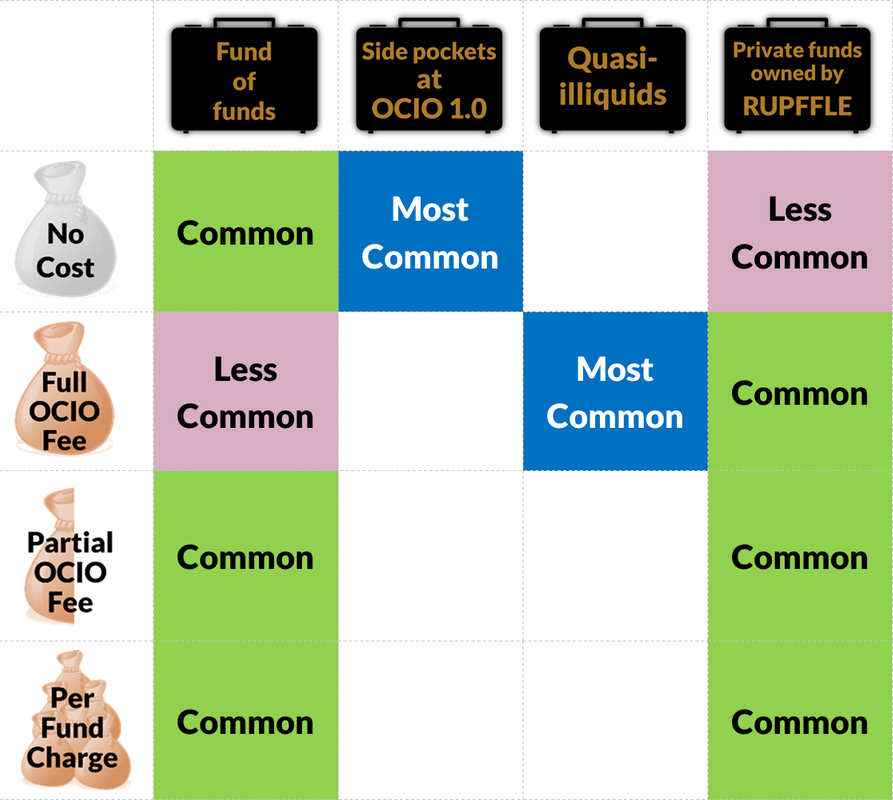

Thinking of hiring an outsourced Chief Investment Officer (“OCIO”)? You’re not alone. OCIO was already on a strong growth trajectory, with global OCIO assets increasing from less than $100B in 2013 to almost $2T in 2020 according to Pensions & Investments. The 2020 market turmoil and global pandemic have accelerated the trend, with over 50% of OCIOs in a recent survey by Chestnut Advisory Group revising their growth projections upwards post-pandemic (for more results from Chestnut’s survey, see their excellent webinar). Some organizations are considering an OCIO model for the first time (we call these OCIO 1.0), while others already adopted the OCIO model but seek to change providers (OCIO 2.0). As search professionals, we at Alpha Capital Management work with a fair amount of organizations seeking OCIO 1.0. We devote an entire project segment, “Explore,” to educating committees and organizations on what to expect from OCIO models, looking at everything from governance to investments to operations. Lately, we are getting more and more inquiries from organizations that already have an OCIO and are seeking a new one – OCIO 2.0. The nice thing about OCIO 2.0 is that the education process should be lighter. Since the organization’s committee is already familiar with the governance model as well as the benefits and features of the OCIO model, our “Explore” phase can be curtailed or eliminated. OCIO 2.0 should be a walk in the park (masks on), right? Wrong. Unfortunately, OCIO 2.0 comes with many considerations. The devil, it turns out, is in the details. For example, the OCIO universe has expanded significantly. Clients considering an OCIO today have more providers and models to learn about and choose from. Also, exiting an OCIO is not as easy as entering an OCIO in many cases. Our OCIO 2.0 clients have a great deal more to consider in terms of liquidity, asset transitions, and timelines as well. The most overlooked complication for OCIO 2.0, though, might just be legacy illiquid assets. This is especially true for our non-profit clients, who almost always hold investments in private investments like real estate, private equity, or private debt. Legacy illiquid assets complicate the transition process to OCIO 2.0. Additionally, the industry has not yet settled on a standard pricing model for many of these assets. It is crucial that organizations consider these assets in their OCIO searches. In this Insight, we hope to shed some light for clients and OCIOs alike on special considerations for legacy illiquid assets. What is a legacy illiquid asset? Cash is king. In a perfect world, an OCIO starts a new client relationship with a blank slate (100% cash or easily liquidated assets). Some OCIO models allow for more or less customization of asset allocation and manager holdings within portfolios, but it’s fair to say that the OCIO model works best when the OCIO, an investment expert, brings the full weight of that investment expertise to bear in designing and implementing a portfolio. Ten years ago or more, it was often true that clients moving to an OCIO model for the first time (OCIO 1.0) did bring mostly cash and liquid securities. Today, the picture looks quite different, especially in the non-profit world. Private equity and other illiquid assets with a long lock-up period have been embraced in big way. According to the National Association of College and Business Officers (NACUBO) via Institutional Investor, “the share of total U.S. nonprofit money invested in alternatives has doubled in the past 15 years.” An average 27.7% allocation to alternatives like private equity across endowments and foundations in 2003 had ballooned to 52% by 2018. As Bloomberg Businessweek put it, “private equity managers won the financial crisis.” And private equity and its brethren far outlive a typical investment committee member, consultant, or OCIO. Therein lies the problem. Let’s follow a fictional non-profit, The Rich Uncle Pennybags School for Financial Literacy and Education (“RUPFFLE”), through their OCIO journey to see how legacy illiquid assets are typically handled. In 2010, RUPFFLE hires its first OCIO and gives over management of its $200M portfolio (all liquid assets) to OCIO 1.0. OCIO 1.0 believes in a heavy weighting to alternatives, and it invests RUPFFLE in a diversified portfolio with 20% in illiquid assets. Unfortunately, RUPFFLE’s portfolio fails to grow, and the organization decides to change OCIOs in 2020. After a search, RUPFFLE hires OCIO 2.0 and transfers assets to the new firm. However, RUPFFLE cannot liquidate the $40M that OCIO 1.0 invested into illiquid assets. OCIO 2.0 instead receives $160M in liquid assets plus a suitcase with $40M in illiquid assets. We will take a look at how this suitcase of illiquid assets is handled by OCIO 2.0 and RUPFFLE over the next few sections. What's in the bag, sir? OCIOs want cash to invest; instead, they receive suitcases. Not only must OCIO 2.0 build around illiquid assets from an investment standpoint, but illiquid legacy assets also require operational support and specialized transition management that OCIO 2.0 must supply. The amount of additional support needed depends on what’s in the suitcase. Here are the most common illiquid assets in the OCIO space. We’ll look at each in turn. Side pockets at OCIO 1.0 and Fund of funds In addition to traditional fund-of-funds run by dedicated companies, some OCIOs offer internal fund-of-funds for clients in illiquid asset classes like private equity. Other OCIOs pool all clients together into one vehicle; when a client leaves, that client gets cash back from the pool for the value of the liquid investments but continues to own a proportion of the illiquid assets (a “side pocket”). Although these assets are illiquid until the fund unwinds, OCIO 1.0 (or the fund-of-funds manager) retains responsibility for monitoring the underlying managers as well as managing capital calls and distributions for the underlying investments. Therefore, OCIO 2.0 has limited responsibility for the assets, other than fulfilling capital calls and reinvesting distributions on the fund-of-funds. Quasi-illiquids These assets are subject to some lock-ups but allow clients to exit before the fund unwinds. Hedge funds are a perfect example, offering quarterly liquidity in many circumstances. Another example are OCIO’s internal fund-of-funds for clients in liquid or quasi-illiquid asset classes. Quasi-illiquids present a transition problem, but they don’t stick around forever. OCIO 2.0 must plan for the liquidation of these assets according to each fund’s terms and conditions. As the assets are liquidated, the OCIO can invest them into the portfolio. Private funds owned by RUPFFLE Direct private investments that clients like RUPFFLE own are the trickiest for OCIO 2.0 to manage. Not only does OCIO 2.0 becomes responsible for managing the capital calls and distributions, but OCIO 2.0 usually takes on responsibility for monitoring the underlying managers. A direct private equity program often has a large number of individual line items as well (perhaps 10-80 individual fund investments), multiplying the operations work for OCIO 2.0. Baggage fees If you thought airlines were the only ones who charged baggage fees, think again. Costs multiply to build back office operations and customize portfolios around the suitcases of illiquids, and the OCIO provides services on these assets, so it seems only fair that there is an associated cost. However, the structure and level of fees vary widely among OCIOs. The most common question OCIOs have for our search professionals at Alpha Capital Management today is, “what is the going rate for legacy illiquids?” Dearest OCIOs, this section is for you. We take a look at the four most fee structures here: No Cost (RUPFFLE pays OCIO fee on $160M) Some OCIOs consider managing around legacy assets to be the cost of doing business and provide basic capital call/distribution services at no cost. The number of legacy positions serviced under this fee structure may be capped, with charges beginning once that threshold has been reached. Full OCIO Fee (RUPFFLE pays OCIO fee on $200M) Some OCIOs offer full service on legacy assets, including ongoing monitoring, due diligence, and active management of positions where appropriate (for example, seeking out opportunities in the secondary markets to liquidate positions, or taking an active LP role). OCIOs believe that there is no difference in the level of service provided on these legacy assets vs. the investments the OCIO itself has made; therefore, the cost is the same. Partial OCIO Fee (RUPFFLE pays OCIO fee on $160M plus reduced OCIO fee on $40M) The rationale is similar for the OCIOs who charge a full fee, in that servicing these assets do increase costs for OCIOs. However, the total level of service required for legacy illiquid assets is perceived to be less than for investments that the OCIO has made and takes full responsibility for, and therefore, the OCIO charges a lesser rate than for its own investments. Per Fund Charge (RUPFFLE pays OCIO fee on $160M plus $2,000 per illiquid fund in the $40M suitcase) By pricing the operational services provided on legacy assets at a completely different rate than assets where the OCIO has investment authority, this pricing structure clearly distinguishes between operational and investment duties of the OCIO. Cost per line item is typically low, which can result in significant savings for portfolios with only a handful of legacy line items, but the charges can add up quickly for fully built direct private portfolios. Cheat sheet Although the OCIO industry has (for the most part) not yet settled on a standard for legacy asset pricing, we can point to some general trends that we at Alpha Capital see emerging over multiple RFP cycles for our clients. Here are the fee arrangements we see the most often for each type of legacy illiquid asset at OCIO 2.0: Remember that the table above only looks at fees charged by OCIO 2.0. OCIO 1.0 may continue to assess fees on legacy illiquid assets (or start charging new fees) that it retains after termination. This may seem obvious for side-pocketed assets, but it is often a point of confusion on fund-of-funds. Read the offering documents carefully for any pooled vehicles to better understand all terms and conditions. As always, it is crucial for organizations to clarify fees and services during the search process. Toward an industry standard As a relatively young industry, outsourced CIOs are still working to create industry standards. Unfortunately, this creates a great deal of confusion for organizations like our fictional friend, RUPFFLE. In the meantime, it is crucial that organizations perform comprehensive due diligence when hiring an OCIO… even if it’s OCIO 2.0. We at Alpha Capital have written previously about other hot topics such as performance and fiduciary responsibilities. Our hope is that the industry continues to move towards a consistent standard for providing services on legacy assets at a fair price. (We are casting our vote for the “partial OCIO fee” model.) Bonus: due diligence questions for legacy assets As a special thank you for reading our insights, here are four questions RUPFFLE and its peers should ask when hiring OCIO 2.0:

5. If we terminate our OCIO relationship, what fees will you continue to assess and on which assets? Want to share this with your colleagues? Download the report here.

Comments are closed.

|

Author

Anna Tabke, CFA, CAIA Interest

All

Archives

April 2022

|

Copyright © Alpha Capital Management