|

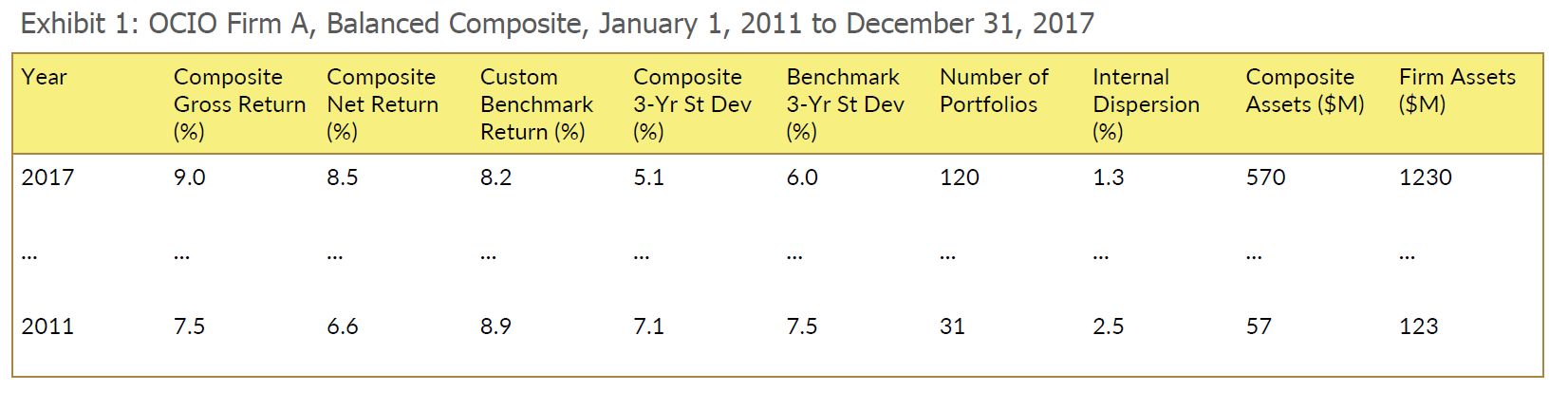

As outsourced Chief Investment Officer (“OCIO”) solutions become more popular with institutional clients, the need to compare firms on a quantitative basis grows greater. If you’ve spent any time talking about the OCIO model with Alpha Capital Management, you’ve likely heard us mention GIPS compliance as an issue. Performance is one important way to draw clear comparisons between investment managers (though, of course, it is not the only factor to consider). Most investment managers in traditional asset classes, especially those who work with institutional clients, claim compliance with Global Investment Performance Standards (GIPS), a globally accepted methodology for calculating and presenting performance information. Prospective clients are able to directly compare investment manager results to measure skill (i.e. alpha). GIPS is not as common yet in the alternative investment space, although that is expected to change in the near future with many hedge funds working toward GIPS compliance. The CFA Institute has been working on a project called GIPS 2020 aimed at improving the standard and increasing adoption, and it is expected to propel adoption of GIPS among alternatives managers. We hope it does the same with OCIOs. We request performance information in our RFPs, but it is a highly imperfect metric. Traditional investment consultants are not usually compliant with GIPS, and performance varies widely between clients due to varying investment policy restrictions, use of alternative assets, individual investment managers, and whether the client implements the consultant’s advice. Many firms provide us with representative account data, which may or may not be relevant to our client. Although some OCIOs invest client assets as a pool where it is very easy to show audited performance, customized OCIO providers face the same issues that traditional consulting firms do: clients have different investment restrictions, different managers, and different objectives. That being said, as OCIO Strategic Investment Group recently said “Yes, OCIOs Can Be GIPS Compliant!” What is GIPS Compliance?GIPS is an established set of principles that standardize the calculation and reporting of investment performance. The GIPS standards are voluntary and based on the fundamental principles of full disclosure and fair representation of performance results. GIPS allows investment management firms to quantify and communicate their performance without misrepresentation. Reference the Global Investment Performance Standards Handbook from the CFA Institute for more information on the standards, which is available for download at the CFA website. Any investment management firm can follow the guidelines set forth by GIPS when calculating its track record, but only firms that manage discretionary assets can claim compliance with GIPS. Compliance cannot be attained by a single product. A firm must follow all requirements of the GIPS standards across all of the firm’s products, or else it may not claim compliance. Moreover, each and every client must be included in one of the composites. The CFA Institute’s GIPS Standards website lists more than 1,500 firms who claim compliance. To date, few OCIOs are among them. Why is GIPS Compliance Useful for OCIO Searches? Simply put, an institution’s ability to judge the OCIO’s ability to beat their benchmark over time, with comfort that the numbers are not cherry-picked or massaged, is paramount in selecting a qualified OCIO. There are several complicating factors to consider, however. Some OCIOs use “building blocks,” where they establish track records for asset class composites like global equity. Examining those records helps gauge skill in manager selection (and to some extent, the ability to combine managers). But what about asset allocation? Unfortunately, looking at building block records doesn’t show if an OCIO has skill in asset allocation, either strategic or tactical. A true GIPS composite gives the institution valuable insight into the ability of an OCIO to manage a total portfolio. GIPS compliance also helps to compare firms on an “apples to apples” basis. In the searches Alpha Capital Management runs for large institutions, we receive performance information that is all over the map. Some firms send us gross numbers, many send us gross of their fee but net of the underlying manager fees, and very occasionally, we get “net-net” numbers (meaning net of underlying management fees AND net of any OCIO fees, representing the end client performance). GIPS would simplify this greatly. Exhibit 1 shows a sample GIPS compliant presentation. It is clear why this is valuable. Not only does the recipient have performance information, but he also has key information necessary to verify the quality of the data going into that calculation. There are some caveats. As discussed earlier, a firm claims compliance with GIPS. An individual strategy cannot be GIPS compliant; every strategy at the firm must be assessed and calculated in line with GIPS, and every account must be put into a composite. For OCIOs with asset management divisions, claiming GIPS compliance can be a very complicated, time consuming, and expensive endeavor. It also reduces a firm’s ability to be flexible in regards to how it shows performance, as it locks the firm into one set method of calculation (even for issues where GIPS allows some leeway, such as in the treatment of legacy client assets, the firm must choose a path and stick to it). There are also many flavors of OCIOs. Some OCIOs offer significantly customized solutions across their client base, while others offer a single pooled investment strategy that all of their clients use. For the latter, GIPS compliance is much more straightforward than the former. What are the Market Trends? We’ve been loudly complaining about the lack of GIPS compliance by OCIOs for quite a long time. For reference, we wrote a piece last summer in which we remark, “it’s ironic that consultants who would never hire an investment manager without a track record ask to be hired without providing their own” (Outsourced CIO: Not a Silver Bullet). We can also point to a recent survey conducted by eVestment and ACA Compliance Group, which showed that three quarters of investment consultants will not consider managers that don’t claim compliance with GIPS for their performance data some or all of the time. (see FundFire's "No GIPS? No Mandate for Most Managers: Report" by Mariana Lemann from August 16, 2018)

In our own OCIO searches, our institutional clients have been focused on performance as a differentiator between firms, and they have been frustrated by the complexity of analyzing the data they receive. This issue matters to the institutional investors who allocate to OCIOs and have the power to demand transparency. We believe that the client demand for transparency and comparability between providers will lead to GIPS standards being more widely adopted by OCIOs. We’re happy to see already that more OCIO firms are talking about GIPS compliance or making progress toward claiming compliance. Strategic Investment Group was an early adopter, as was Angeles Investment Advisors. Highland Associates and Aon recently announced GIPS compliance, and we have spoken to several other OCIOs or consulting firms who are in various stages of reviewing, calculating, or claiming compliance with GIPS. We firmly believe that the industry will reach a “tipping point” where the major players are GIPS compliant, and competitors must follow their example to stay relevant. The move toward transparent, verifiable performance calculations is a great thing for investors, and we highly encourage it. We applaud OCIO and consulting firms who have recognized this and are taking action. We hope to be able to exclude firms who do not claim compliance with GIPS or have audited numbers from our OCIO searches, but right now, there are not enough compliant firms to do so. As the OCIO industry develops, institutionalizes, and evolves, we think that adopting clear, verified standards of performance is the best possible way for institutions to differentiate between OCIO providers’ performance. We will do all we can to usher in this new era of transparency. Want to download a copy of this report to share? Click here. Comments are closed.

|

Author

Anna Tabke, CFA, CAIA Interest

All

Archives

April 2022

|

Copyright © Alpha Capital Management