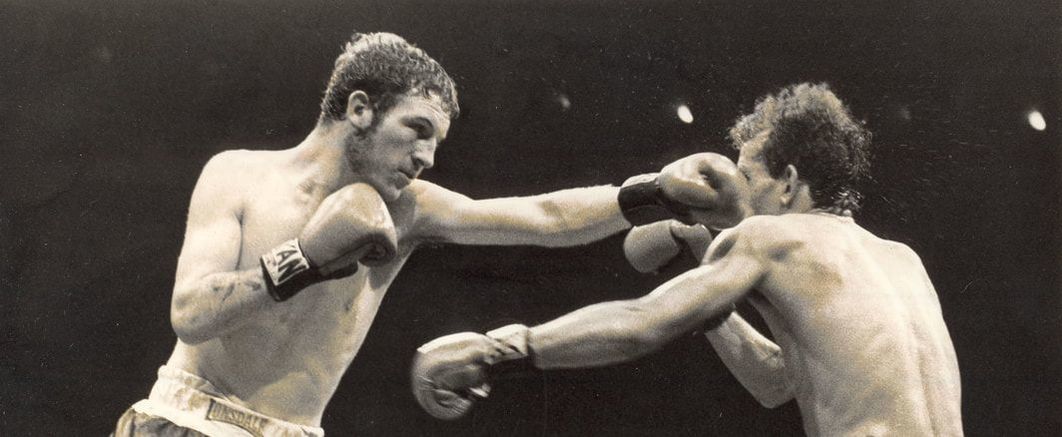

CONSULTANTS GET THE ONE-TWO PUNCH: HEDGE FUNDS & ACTIVE MANAGEMENT We believe 2017 will go down as the year with the highest turnover of investment consulting relationships since the aftermath of the 2008 financial crisis. We assist institutions with investment consultant searches, so we have a ringside seat for the action, and we are amazed at the number of RFPs going out so far this year. One consulting firm we spoke with has already received double the amount of RFPs that they do in a typical year – and we aren’t even 6 months in. Considering that 20-30% turnover is normal in this business, this is a significant increase. Institutions are ready to make a change – but why now? We have spoken to several consulting firms and institutions about this, and we have identified two major themes driving this uptick in activity. THEME 1 : ALTERNATIVES-HEAVY PORTFOLIOS OUT OF FAVOR Alternatives have become a common component of many institutional portfolios over the past several years, with hedge funds serving a key role. Given the complex nature of these alternative-heavy investment portfolios, consulting firms had a strong value proposition to offer these institutions: identify the top managers with intensive research and due diligence using the firms’ extensive resources. Hedge funds performed well in the 1990s and through the 2000-2002 downturn; in fact, many of the best fund managers became household names (Julian Robertson, George Soros, and their peers). Unfortunately, hedge funds did not hold up as well in the 2008 downturn, with the average fund down about 20%, and they have struggled ever since. With one large component of the portfolio seemingly out for the count, we have reached a tipping point for investment committees, organization staff, and plan sponsors to reevaluate their alternatives exposure – and with it, the consultants who recommended it. THEME 2 : PASSIVELY MANAGED FUNDS OFFER CHEAPER, BETTER RESULTS THAN ACTIVE COUNTERPARTS In institutional circles, popular media, and the private wealth space, active is out. Investors want results, and cheap, passively managed investments have delivered better results than expensive active managers in this market cycle. Institutions and their advisory boards have embraced passive management for many reasons, including lower fees but also continued political backfire from active investment performance. Yet we continue to meet with consulting firms that believe active management is the only way to go in a portfolio. One argument we hear is that active management outperforms over long periods of time (8-10 years) thanks to superior downside protection. Unfortunately the tenure for most board members is shorter than this record-breaking bull market. The board is ultimately responsible for the welfare of the investment portfolio, and the financial and emotional toll of an all-active portfolio in this market environment is already high and keeps rising. Consulting firms that disregard the role of passive investments in a portfolio increasingly do so at their own peril. KNOCKOUT Only time will tell the winner as consulting firms continue to evolve in this new investment paradigm. Though these two themes dominate many conversations we have with investment committees and plan sponsors, the fact remains that governance best practice calls for a review of service providers every five to seven years regardless of performance. If you are interested in retaining an RFP consultant to guide you through the process, we would be happy to share our perspective. Comments are closed.

|

Author

Anna Tabke, CFA, CAIA Interest

All

Archives

April 2022

|

Copyright © Alpha Capital Management